Another L For 150 Hours: Illinois Might Have Two New CPA Pathways Soon

Going Concern

FEBRUARY 3, 2025

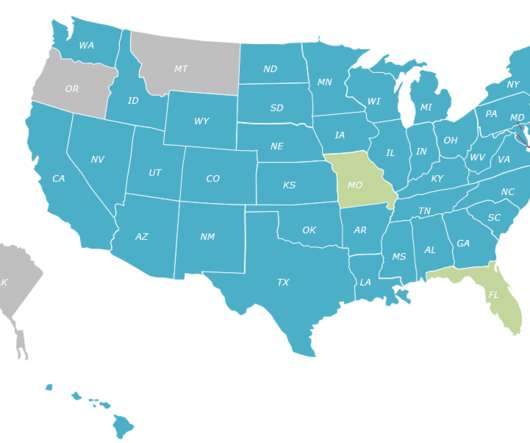

Similar new pathways to licensure are also being explored or pursued legislatively in many of our neighboring states, including Michigan, Missouri, and Wisconsin. Instead, this legislation establishes two additional pathways to obtain a CPA license in Illinois, explains ICPAS President and CEO Geoffrey Brown, CAE.

Let's personalize your content