Andersen Merges in Berman & Associates in Georgia

CPA Practice

JULY 17, 2025

The global professional services firm has opened its first office in Georgia after merging with Atlanta-based tax and accounting firm Berman & Associates.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Georgia Related Topics

Georgia Related Topics

CPA Practice

JULY 17, 2025

The global professional services firm has opened its first office in Georgia after merging with Atlanta-based tax and accounting firm Berman & Associates.

TaxConnex

NOVEMBER 14, 2024

For instance, if the sale above involved Georgia instead of Illinois, the South Carolina retailer could have just issued to the distributer a Georgia resale certificate with their South Carolina sales and use tax registration number on it to exempt this transaction from Georgia use tax.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

CPA Practice

DECEMBER 3, 2024

Staff reports The Albany Herald, Ga. TNS) ATHENS, GA (Nov. 27)—A tax preparer who admitted to filing more than $3 million in fraudulent tax returns on behalf of her clients is facing up to 30 years in prison for her crime.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

TaxConnex

JULY 15, 2025

Just last year Georgia and Florida became two of the latest to levy sales tax on Netflix. Obviously, it doesn’t take the likes of Hulu or Netflix to rack up thousands of “transactions” in just a few days in most states – though many states, like Illinois or, more recently, Utah, are dropping their transaction-based thresholds.

CPA Practice

JULY 17, 2025

Jason Bramwell Mergers and Acquisitions July 17, 2025 Andersen Merges in Berman & Associates in Georgia The global professional services firm has opened its first office in Georgia after merging with Atlanta-based tax and accounting firm Berman & Associates.

CPA Practice

JUNE 30, 2025

million – $4,999,999 $5 million – $10,000,000 Over $10 million Consent Policy (Required) By downloading this content, you agree to our Terms and Conditions.

Accounting Today

JULY 25, 2025

million hours of volunteering globally for causes crucial to the many places Sage operates in — ranging from Vancouver, Canada and Atlanta, Georgia, to Cape Town, South Africa, and Bengaluru, India. …

CPA Practice

JULY 8, 2025

Accounting July 7, 2025 Sage Future 2025 Sets a New Standard for High-Performance Finance Held at the Georgia World Congress Center in Atlanta from June 2–5, the event gathered thousands of attendees eager to explore the future of high-performance finance. In this CPE-eligible panel, we’ll unpack firsthand insights from the field.

Accounting Today

JULY 17, 2025

Practice management M&A Georgia MORE FROM ACCOUNTING TODAY Tax IRS enforcement efforts hit by cutbacks The IRSs progress in improving tax compliance in recent years has been threatened by cuts in funding and hiring, according to a new report. In the U.S., Andersen has more than 2,000 people in 25 cities.

Accounting Today

JULY 10, 2025

Augusta, Georgia: Two ghost preparers have pleaded guilty to a tax scheme. By Jeff Stimpson July 10, 2025, 6:14 p.m. EDT 6 Min Read Facebook Twitter LinkedIn Email Underhanded underground; down on the farm; reality check; and other highlights of recent tax cases. Kim Brown, 40, pleaded guilty to preparing and filing false 1040s for clients.

Accounting Today

JULY 21, 2025

Union City, Georgia: Truck driver Dantavious Jackson, 39, who operated a ghost tax prep business, has pleaded guilty to making claims for refunds of false pandemic-related employment tax credits. EDT 6 Min Read Facebook Twitter LinkedIn Email Big rigged; fearsome foursome; NYPD blue; and other highlights of recent tax cases.

Menzies

JULY 23, 2025

close close Contact our Specialists Senior Manager Sean Hill About Sean Hill Senior Manager Georgia Gibson-Smith About Georgia Gibson-Smith The post Crypto Investors: HMRC’s New Reporting Rules Coming in 2026 was written by Menzies Harry Payne and appeared first on Menzies LLP.

Accounting Today

JUNE 13, 2025

GEORGIA NABA president and CEO Guylaine Saint Juste (left) and Bennett Thrasher partner Durran Dunn RTW Photography Bennett Thrasher, Atlanta, announced its philanthropic arm, the Bennett Thrasher Foundation, made an investment in the National Association of Black Accountants.

CPA Practice

NOVEMBER 14, 2024

The agency has also been honored with awards from other reputable brands including The Recorder (California), Daily Report (Georgia), Texas Lawyer, National Law Journal (Midwest and Washington, DC), New Jersey Law Journal, New York Law Journal and Connecticut Law Tribune (New England). “We

CPA Practice

JULY 18, 2025

Jason Bramwell Mergers and Acquisitions July 17, 2025 Andersen Merges in Berman & Associates in Georgia The global professional services firm has opened its first office in Georgia after merging with Atlanta-based tax and accounting firm Berman & Associates.

Going Concern

APRIL 7, 2025

In Georgia, the city of Jonesboro is struggling to keep finance people on staff. The contract with CliftonLaresenAllen [sic] has been renewed once every five years. The state auditor was worked with CliftonLarsenAllen [sic lol] for 20 years and is up for renewal this year. Last month, Mayor Donya Sartor resigned then changed her mind.

Accounting Today

AUGUST 8, 2025

GEORGIA Mauldin & Jenkins, Atlanta, joined The International Accounting Group and TAG Alliances. FLORIDA Matt Crockett Matt Crockett, executive director in the tax practice at EY, Tampa, was selected to join the Leadership Tampa cohort at the Tampa Bay Chamber.

Accounting Today

JULY 24, 2025

EDT 1 Min Read Facebook Twitter LinkedIn Email A train at the CSX Intermodal Terminals rail yard in Fairburn, Georgia Megan Varner/Bloomberg The Securities and Exchange Commission dropped its probe of CSX Corp.s previously reported accounting errors and certain non-financial metrics, the company disclosed on Wednesday.

Going Concern

JULY 14, 2025

Williams, in a press release that also singled out an American accounting firm based in Marietta, Georgia: Goldman & Company, CPA’s, P.C. “That isn’t how I see AI,” Benioff, Salesforce’s CEO, told Atlantic CEO Nicholas Thompson during a recent onstage interview at the 2025 AI for Good Global Summit.

Accounting Today

JUNE 26, 2025

Georgia: Attorney Nevada M. Knauss III, Westlake Village, indefinite from Dec. Connecticut: Attorney Scott M. Schwartz, Berlin, indefinite from March 18, 2025. Florida: Attorney William Kalish, Tampa, indefinite from Oct. Tuggle, Duluth, indefinite from March 18, 2025; CPA William B. Tomasello, Forest Park, and CPA Victor C. 21, 2025.

Accounting Today

JULY 18, 2025

GEORGIA UHY Consultings UHY Change Academy, Atlanta, launched CCMP Accelerator, a new 3.5-day DELAWARE Herbein + Co. relocated its Wilmington office to Wells Fargo Tower, effective July 21, located at 2200 Concord Pike. FLORIDA Leif Novie was hired as a partner in the private client services practice at CohnReznick, South Florida.

Accounting Today

JULY 28, 2025

EDT 2 Min Read Facebook Twitter LinkedIn Email Courtesy of Doeren Mayhew Doeren Mayhew, a Top 50 Firm based in Troy, Michigan, has expanded to the greater Atlanta region with the addition of AGL CPA Group, in Duluth, Georgia, effective July 16. AGL brings more than 20 employees to Doeren Mayhew.

Accounting Today

JULY 11, 2025

GEORGIA Shelly Carmichael Smith + Howard, Atlanta, launched two new tax practices: site selection + incentives, led by Shelly Carmichael, and state and local income tax consulting, led by Brandee Tilman.

Accounting Today

JULY 28, 2025

Long was sworn in a little over a week ago and one of the first events he attended was a graduation ceremony in Georgia for IRS Criminal Investigation Unit agents. However, he admitted he came in last place among the 21 contenders. He was asked about his plans for implementing the massive new tax bill and joked about the name. "I

Going Concern

APRIL 25, 2025

Former KPMG manager working remotely in Georgia can sue under New York law, court says [ HR Dive ] At the height of the COVID-19 pandemic, KPMG hired the manager, who is African-American, to work in New York City, according to court records.

TaxConnex

JULY 31, 2025

million in sales tax on rides in Georgia from 2012 to 2015 after s state court bounced the company’s argument that the state should have collected that amount from drivers, not from the app. As services continue to evolve, so do sales tax questions about them. Uber Technologies, for instance, had to pay $8.92

Going Concern

JULY 7, 2025

The Columbus Ledger-Enquirer of Georgia has done an interesting deep dive on the rot within the city government’s finance department and how a certain event in 2020 concealed it for years: This year, former Columbus city manager Isaiah Hugley was fired.

Accounting Today

JULY 3, 2025

GEORGIA Rebekah Judge Nicole Tyler Rebekah Judge was hired as a partner in the tax practice area at Moore Colson, Atlanta. Lake is a director of tax services at Berkowitz Pollack Brant Advisors + CPAs, where she leads the state and local tax practice.

TaxConnex

JULY 1, 2025

Georgia has adopted a rule on digital products, goods and codes for sales and use tax purposes. These services include IT; custom website development; investigation, security and armored cars; temporary staffing; advertising; live presentations; and sales of custom software and customization of prewritten software.

CPA Practice

JULY 31, 2025

He also emphasized that early participation is likely to skew toward families already in private schools, particularly in wealthier ZIP codes—mirroring patterns seen in programs in Arizona, Florida and Georgia. What do these programs look like across the country?

CPA Practice

JULY 7, 2025

Held at the Georgia World Congress Center in Atlanta from June 2–5, the event gathered thousands of attendees eager to explore the future of high-performance finance.

CPA Practice

OCTOBER 22, 2024

million – $4,999,999 $5 million – $10,000,000 Over $10 million Consent Policy (Required) By downloading this content, you agree to our Terms and Conditions.

CPA Practice

JULY 10, 2025

CNBC’s Top States for Business in 2025 North Carolina Texas Florida Virginia Ohio Michigan Georgia Tennessee Indiana Minnesota _ ©2025 The Charlotte Observer. What may prevent North Carolina from repeating at No. Visit charlotteobserver.com. Distributed by Tribune Content Agency LLC. Thanks for reading CPA Practice Advisor!

Accounting Today

APRIL 7, 2025

Legislation providing two pathways to a CPA license unanimously passed both chambers in the Georgia General Assembly and is awaiting the governor's signature.

CPA Practice

JUNE 9, 2024

Rosie Manins, The Atlanta Journal-Constitution (via TNS) The trade association for online marketplaces including Google, Amazon and eBay is trying to void a new Georgia law that extends requirements for collecting seller information, alleging it will hurt Georgia businesses. It’s unclear to us why Georgia decided to go down this path.”

Cherry Bekaert

JUNE 9, 2023

Contributors : Chris Grimes, Senior Manager, State & Local Tax | Peter Baisch, Senior Manager, State & Local Tax Georgia IRC Conformity and Section 174 On May 2, 2023, Georgia Senate Bill 56 was signed into law, which updated Georgia’s Internal Revenue Code (IRC) conformity date from January 1, 2022, to January 1, 2023.

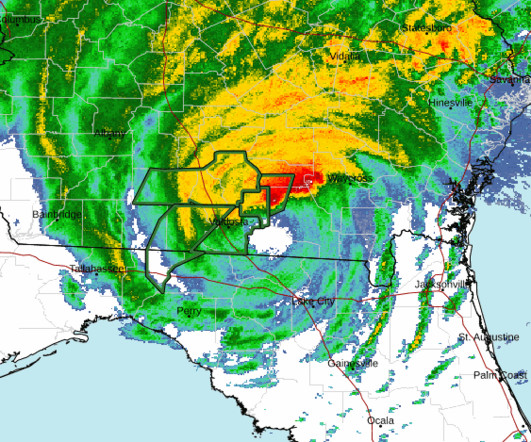

CPA Practice

AUGUST 30, 2023

As of noon Eastern time, the hurricane was still a Category 1, and moving over southern Georgia. link] Hurricane and tropical storm warnings are now posted for most of the southern part of Georgia, as well as parts of South and North Carolina, where “significant storm surge will continue,” the agency stated.

CPA Practice

SEPTEMBER 12, 2024

Marking its 11th anniversary, the 2024 Georgia Accounting Food Fight has concluded with resounding success, further cementing its commitment to ending hunger across the state. It provides critically needed resources to Feeding Georgia food banks.” Fundraisers like the Georgia Accounting Food Fight are more crucial than ever.

TaxConnex

JANUARY 19, 2023

The wording of the Georgia Department of Revenue offers a guide to what states expect: “An individual can be liable for the unpaid taxes of a business. Question of will Just as economic nexus and taxability are not the same in every state, personal responsibility laws also differ.

CPA Practice

SEPTEMBER 13, 2023

The Internal Revenue Service today announced tax relief for individuals and businesses affected by Idalia in 28 of the state’s 159 counties in Georgia. These taxpayers now have until Feb. 15, 2024, to file various federal individual and business tax returns and make tax payments.

TaxConnex

DECEMBER 12, 2023

For example, in Georgia : “An individual can be liable for the unpaid taxes of a business. When a business fails to pay the taxes it has collected or should have collected to the Georgia Department of Revenue, the Department sends an assessment notice to the person it has identified as responsible for payment.

CPA Practice

APRIL 8, 2025

This legislation introduces significant reforms to the CPA licensure process and broadens practice privilege mobility, reflecting Georgia's commitment to a dynamic and accessible accounting profession.

Accounting Today

SEPTEMBER 13, 2023

The IRS is pushing back filing and payment deadlines for those impacted by the storm.

CPA Practice

JANUARY 31, 2023

More than 100 members of The Georgia Society of Certified Public Accountants (GSCPA) recently met at the state Capitol to share their thoughts on important issues facing the accounting profession with their elected officials. Chairman David Knight and each member of the Georgia CPA Caucus: Chairman John Carson, Rep.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content