Sales tax and streaming services

TaxConnex

JULY 15, 2025

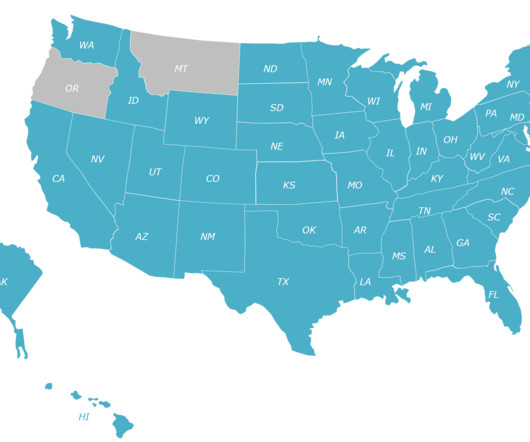

Digital products” are generally taxable in Alabama, Connecticut, Idaho, Iowa, Kentucky, Louisiana, Minnesota, Mississippi, Nebraska, North Carolina, Ohio, Utah, Vermont, Wisconsin and Wyoming.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Vermont Related Topics

Vermont Related Topics

TaxConnex

JULY 15, 2025

Digital products” are generally taxable in Alabama, Connecticut, Idaho, Iowa, Kentucky, Louisiana, Minnesota, Mississippi, Nebraska, North Carolina, Ohio, Utah, Vermont, Wisconsin and Wyoming.

TaxConnex

MAY 22, 2025

States that do exempt clothing, such as Vermont and Pennsylvania (except for fur items in the latter), exempt a lot. Worn by humans Almost all states with a statewide sales tax treat sales tax on clothing differently, and a few states dont levy a statewide sales tax it at all (including, of course, the NOMAD states).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

CPA Practice

JUNE 30, 2025

million – $4,999,999 $5 million – $10,000,000 Over $10 million Consent Policy (Required) By downloading this content, you agree to our Terms and Conditions.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Accounting Today

JULY 25, 2025

VERMONT The Vermont Society of CPAS, Brattleboro, elected its executive committee and board of directors for the 2025-26 term: chairperson Kevin Markowski, vice-chair and chairperson-elect Ryan Black-Deegan, secretary Angela Guinness, treasurer Matt Cleare; and as directors: Karen Bartlett, James Manning and Nate Lalonde.

Accounting Today

AUGUST 5, 2025

In June, Prosperity Partners expanded to Vermont by adding Danaher, Attig & Plante. Citizens Capital Markets & Advisory served as exclusive financial advisor to Pipaya, and Miles & Stockbridge P.C. served as legal counsel. Kirkland & Ellis LLP served as legal advisor to Prosperity.

CPA Practice

NOVEMBER 25, 2024

Suzanne Lowensohn Appointed as GASAC Vice Chair Dr. Lowensohn, an associate professor of accounting and Director of the Master of Accountancy program at the University of Vermont, Grossman School of Business, has been appointed to serve as vice chair of the GASAC.

CPA Practice

OCTOBER 22, 2024

million – $4,999,999 $5 million – $10,000,000 Over $10 million Consent Policy (Required) By downloading this content, you agree to our Terms and Conditions.

Accounting Today

AUGUST 14, 2024

Everyone in the state who was affected by the storm now has until Feb. 3 to file and pay.

TaxConnex

NOVEMBER 3, 2020

In Vermont , three letters can mean a lot. Retailers must now register to collect Vermont sales tax if they reached the $100,000 sales or 200 transactions “during the 12-month period preceding the monthly period with respect to which that person’s liability for tax under this chapter is determined.”.

TaxConnex

APRIL 9, 2024

Mississippi exempts vitamins and supplements purchased with food stamps; Vermont does so for purchases through the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC).

TaxConnex

AUGUST 1, 2024

Vermont lawmakers have overridden a gubernatorial veto and passed legislation to repeal, as of July 1 this year, the state’s sales and use tax exemption for remotely accessed prewritten computer software, aka cloud software or Software as a Service (SaaS). 1, 2024, and before July 1, 2025.

TaxConnex

NOVEMBER 2, 2021

The products are tax-exempt (more or less) in the District of Columbia, Florida, Maryland, Michigan, New Jersey, New York, Texas, Vermont, West Virginia and Wyoming. Most states have no special rules for supplements and vitamins.

TaxConnex

JANUARY 11, 2022

When only some of the contents of a shipment are taxable, the shipping charges must be pro-rated in Minnesota, New Jersey, North Carolina, North Dakota, Ohio, Rhode Island, South Dakota, Vermont, Washington and Wisconsin (where a “reasonable allocation” is required).

Accounting Today

JULY 13, 2023

Victims will now have until Nov. 15, 2023, to file their individual and business tax returns and make tax payments, pushing back the Oct. 16 deadline.

PYMNTS

FEBRUARY 26, 2020

PSCU’s Lumin Digital has signed the Vermont State Employees Credit Union (VSECU) to a multi-year digital banking and cloud computing agreement, Lumin announced on Wednesday (Feb. Founded in 1947 in Montpelier, Vermont, VSECU strives to offer its nearly 70,000 members economical savings and credit. .

Cherry Bekaert

JULY 26, 2024

On June 17, 2024, the Vermont legislature made a significant change by enacting legislation ( Vt. 887, Vermont only imposed sales and use tax on tangible personal property and a few specific services. Prior to the enactment of Vt.

CPA Practice

JUNE 4, 2025

The private equity-backed tax and accounting firm has entered Vermont after acquiring Danaher Attig & Plante, a South Burlington-based public accounting firm.

TaxConnex

OCTOBER 5, 2021

Excise taxes vary widely from state to state, but in recent years states collecting the highest per-capita excise taxes include Vermont, Nevada, Hawaii, Minnesota, and Maryland. Latest estimates are that at the federal level the U.S. collects about 4% of its revenue from excise taxes.

PYMNTS

MARCH 1, 2016

As anyone who has ever ventured to Vermont can affirm, it’s a very particular place for some very particular people. Despite being nearly geographically identical to its neighbor to the east , New Hampshire, Vermont is very much its own place. By The Store Front Numbers . On The Ground. Unsurprisingly, since he is their senator.

Accounting Today

JULY 19, 2024

Vermont, North Carolina, New Jersey and Ohio provide standout examples this summer. You need to be on your toes if you work in sales tax, as states are known to make substantial sales tax policy changes with little to no notice.

TaxConnex

SEPTEMBER 5, 2024

Vermont : Taxable if the item is. South Dakota: Taxable unless the item is exempt or the charge is separate from the sale. Tennessee: Taxable if the item is. Texas: Taxable if the item is. Utah: Exempt if separately stated. Virginia: Exempt if separate stated but handling is taxable. Washington: Taxable if the item is.

TaxConnex

SEPTEMBER 26, 2024

In other states, exemption certificates expire after set periods, such as one year in Alabama and three years in Connecticut, Illinois (where three years is the recommended update period for a resale certificate), Iowa and Louisiana.

TaxConnex

JANUARY 17, 2023

Connecticut, Georgia, Michigan, North Dakota, South Carolina, Tennessee, Texas, Vermont, Washington, West Virginia and Wisconsin follow this rule. When items in a shipment are exempt from sales tax in a given state, so is the cost of shipping.

CPA Practice

OCTOBER 3, 2024

Vermont was the most impacted by “tipflation,” with 71% of residents saying they tip regularly across business categories included in the study, results show. On the flip side, respondents opted against a gratuity at auto shops, fast-casual eateries and concession stands, according to survey results.

TaxConnex

FEBRUARY 23, 2023

All other states (except the five that still don’t have a sales tax) followed in the 1960s, capped by Vermont in 1969. These were followed in the 1940s by Florida, Tennessee, Maryland, Connecticut, Rhode Island and the District of Columbia; and in the 1950s by Maine, Pennsylvania, South Carolina, Georgia and Nevada.

TaxConnex

OCTOBER 18, 2022

Minnesota, Pennsylvania, Vermont and Rhode Island and New Jersey do just the opposite for protective and some other specialized clothing. California, Idaho and Tennessee exempt only clothing sales for some nonprofits, for example. South Carolina, Ohio and Virginia exempt some protective clothing.

Going Concern

AUGUST 14, 2024

According to the full consumer communication filed with the Vermont attorney general [ PDF ], HW&B is offering a year of identity monitoring services through IDX. Heier Weisbrot & Bernstein, LLC completed its analysis of the personal information contained in its tax software on July 29, 2024.

TaxConnex

MAY 11, 2023

Vermont was the last to due so in 1969. A state has not added a statewide sales tax since Richard Nixon was in the White House. There are five remaining states with no state level sales tax: New Hampshire, Oregon, Montana, Alaska and Delaware – often referred to as the NOMAD states.

TaxConnex

MAY 2, 2023

Vermont was the last state to adopt a sales tax, in 1969. Mike Dunleavy is reportedly preparing to introduce a sales tax as part of a long-term budget plan for the state. Five states don’t have a statewide sales tax: New Hampshire, Oregon, Montana, Alaska and Delaware (aka the “NOMAD” states).

Going Concern

SEPTEMBER 27, 2023

Check the chart if yours isn’t listed above.

CPA Practice

FEBRUARY 19, 2024

Vermont, with high business loan approval rates, high minority-owned startup growth, low unemployment, and lower income disparities, takes the spotlight as the number one state for minority entrepreneurship. Click for larger images. The 20 best states for minority entrepreneurs.

CPA Practice

OCTOBER 27, 2023

Currently, this includes: All employers in Vermont have until Nov. 31 deadline postponed for disaster area employers Employers and other taxpayers in federally declared disaster areas have more time to file and pay. This includes the Oct. 31 payroll tax deadline. 15, 2023, to file and pay. 15, 2024, to file and pay.

PYMNTS

DECEMBER 17, 2020

A spokesperson for the Silicon Valley company told ABC that Paxton's claims are "meritless," adding that "we will strongly defend ourselves from (Paxton's) baseless claims in court.”.

CPA Practice

OCTOBER 2, 2023

Those affected by flooding in Vermont. For 2023, however, many taxpayers who had received an extension to file, also later faced various forms of natural disasters for which the IRS has granted additional time to file. These areas include: Taxpayers affected by flooding in Illinois and Alaska. They have until Oct. 31, 2023, to file.

PYMNTS

DECEMBER 14, 2020

Over the last year, POWDR has been working to bring Square hardware, software and payments to its mountains, the release stated, including Boreal, Soda Springs and Woodward Tahoe in California; Copper Mountain and Eldora in Colorado; Killington, Vermont; Lee Canyon, Nevada; Mt.

CPA Practice

OCTOBER 18, 2024

The Vermont Society of Certified Public Accountants (VTCPA) recently announced the hiring of Sadie Fischesser as the Society’s new Executive Director. Sadie has recent experience in operations with the State of Vermont and she brings a background in non-profit leadership and management.

CPA Practice

DECEMBER 13, 2023

States with the least interest in finding a side hustle are Florida, Vermont, and Maine – all of which are on the East Coast. States with the highest level of interest in side hustle jobs in 2023 are Washington, Oregon, Idaho, and Utah – which could mean that the western U.S. is feeling the economic impact the most.

TaxConnex

AUGUST 17, 2023

Vermont , for example, recently expanded its sales and use tax exemption for manufacturing machinery and equipment so that manufacturing machinery and equipment that is part of an integrated production process will be exempt. Sales tax laws are constantly changing for manufacturers.

CPA Practice

OCTOBER 16, 2023

Those affected by flooding in Vermont. For 2023, however, many taxpayers who had received an extension to file, also later faced various forms of natural disasters for which the IRS has granted additional time to file. These areas include: Taxpayers affected by flooding in Illinois and Alaska. They have until Oct. 31, 2023, to file.

PYMNTS

OCTOBER 29, 2020

During the week ending Oct. Unemployment has been high since the pandemic began. Since the week ending March 20, more than 55 million individuals have filed for new unemployment insurance claims.

CPA Practice

SEPTEMBER 9, 2024

Taxpayers in all or parts of Florida , Georgia , Kentucky , Minnesota , Missouri , North Carolina , Puerto Rico , South Carolina , South Dakota , Texas , Vermont , and the Virgin Islands have until Feb. Currently: Taxpayers in parts of Arkansas , Iowa , Mississippi , New Mexico , Oklahoma , Texas , and West Virginia have until Nov.

CPA Practice

OCTOBER 16, 2024

After Vermont added an additional tax on soft drinks in 2015, some retailers said compliance was “a nightmare.” And even when you say these items are at this percent and these are at another percent, then our registers don’t work that way.” Retailers in other parts of the country have faced similar challenges.

Accounting Today

JUNE 4, 2025

Louis, and Prosperity enters Vermont. Carr, Riggs & Ingram expands into East Texas, while UHY continues its growth in St.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content