How AI is transforming accounting

Accounting Today

APRIL 29, 2024

A recent survey from EY found that 90% of respondents already use at least some AI in their work, and other recent developments around the technology.

Accounting Today

APRIL 29, 2024

A recent survey from EY found that 90% of respondents already use at least some AI in their work, and other recent developments around the technology.

Basis 365

APRIL 10, 2024

A business’s ability to remain agile will ensure it can quickly adapt to emerging trends and opportunities. Agility is not only a mindset of the team but the infrastructure the business has built over the years. Bogging your business down with layers upon layers of employees and middle management can prevent you from seizing an opportunity faster than your competitors.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Reckon

APRIL 29, 2024

Guest post by AON. Here’s why keeping appropriate records can help during a claim. In a world where almost everything is paperless, keeping records and filing documentation is something that might slip your mind as you go about your usual business. While digitisation has made record keeping easier in some ways, it has also brought about some complexities.

CPA Practice

APRIL 22, 2024

By Chris Stephenson and Eric Hylton. The race to integrate Artificial Intelligence into the workflow of Certified Public Accountants is no longer a futuristic concept, but a current reality. Large accounting firms have made substantial strides in using AI to augment their services and deliver high quality outcomes. Yet, for many CPA firms, particularly small to mid-sized organizations, the current pace of technological advancement can seem dauting.

Advertisement

The office of the CFO is rapidly evolving, with more and more demands being placed upon the finance and accounting team each year. Join us in this webinar, where we share 8 things to NOT do when it comes to helping the CFO office advance in supporting the business. Learning Objectives: This course objective is to understand how best to support an organization's finance leadership.

CPA Practice

APRIL 16, 2024

By Lizzy McLellan Ravitch. The Philadelphia Inquirer (via TNS) Molly Kowal decided to become an accountant in part because she knew it would be a stable career. After graduating from college in 2021, she saw friends in other fields struggling to find work but knew she would be able to find a job. But that doesn’t mean she’s willing to work into the wee hours during busy season.

TaxConnex

APRIL 25, 2024

There’s nothing like just walking down the hall of your office or clicking into a virtual team meeting to get an answer on something as complex and important as your company’s sales tax obligations. To handle sales tax in-house, you need someone on staff who understands evolving rules and regulations; can track a galaxy of filing deadlines and notices; and understands how your company growth changes tax obligations.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Going Concern

APRIL 19, 2024

Rightworks has released their inaugural 2024 Accounting Firm Technology Survey and the results tell us what we already done knew: Accounting firms are hesitant to adopt next-gen technology. Hell, a bunch of them are hesitant to move to the cloud. In 2024. The survey of decision makers and influencers at accounting, tax and bookkeeping firms revealed that nearly 60 percent of respondents identified their firms as slow adopters of new technologies like AI.

Insightful Accountant

APRIL 29, 2024

Insightful Accountant proudly announces this year's Top 100 ProAdvisors along with our Emeritus ProAdvisors of the Year. Congratulations to all being recognized for this year's awards.

RogerRossmeisl

APRIL 24, 2024

As reported in IR-2024-46 Using Inflation Reduction Act funding and as part of ongoing efforts to improve tax compliance in high-income categories, the Internal Revenue Service announced on 2/21/24 plans to begin dozens of audits on business aircraft involving personal use. The audits will be focused on aircraft usage by large corporations, large partnerships and high-income taxpayers and whether for tax purposes the use of jets is being properly allocated between business and personal reasons.

BurklandAssociates

APRIL 23, 2024

Many startup founders fail to realize that neglecting HR compliance can lead to significant red flags during investor due diligence. The post 3 Common HR “Gotchas” That Could Get You During Due Diligence appeared first on Burkland.

Speaker: Dylan Secrest, Founder of Alamo Innovation and Construction Digital Transformation Consultant

Construction payment workflows are notoriously complex when you consider juggling multiple stakeholders, compliance requirements, and evolving project scopes. Delays in approvals or misaligned data between budgets, lien waivers, and pay applications can grind progress to a halt. The good news? It doesn't have to be this way! Join expert Dylan Secrest to discover how leading contractors are turning payment chaos into clarity using digital workflows, integrated systems, and automation strategies.

TaxConnex

APRIL 30, 2024

More states are plowing ahead with adding a new kind of expense to delivering in the eCommerce age. In what states do you have to watch for retail delivery fees (RDFs)? Q: Is this a “tax” or a “fee”? A: Most states refer to it as a fee, a distinction that allows lawmakers to avoid the voting process. RDFs are a relatively new concept: Colorado was first to roll one out, in July 2022.

Accounting Today

APRIL 30, 2024

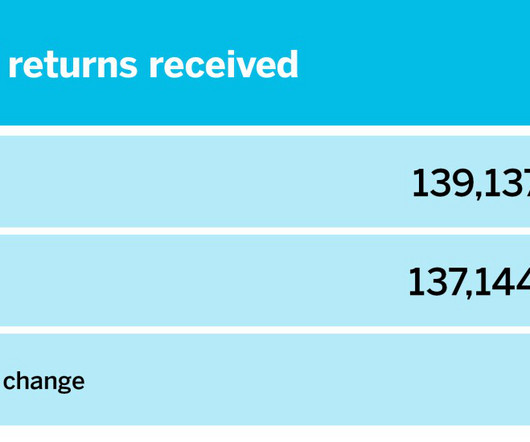

The number of individual income tax returns received rose by 16.34% in the final week of tax season.

CPA Practice

APRIL 23, 2024

From: Entrepreneurs’ Organization | Inc. [Via TNS.] By Kent Lewis, an Entrepreneurs’ Organization (EO) member in Portland, Oregon, is the founder of pdxMindShare , an online career community focused on Portland professionals: I recently shared a presentation on increasing employee engagement and retention by fostering a Culture of Caring with a group of Silicon Valley entrepreneurs.

Cherry Bekaert

APRIL 23, 2024

Download Whitepaper The impact of artificial intelligence on how we live, work and do business has been undeniable for over a decade. Its practical applications range from suggesting the next sentence when crafting emails to producing lifelike animations, from enabling smart and interconnected manufacturing robots to efficiently distribute workloads on assembly lines to predicting customers’ preferences or even helping land a plane.

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

RogerRossmeisl

APRIL 30, 2024

According to the Treasury, the US government has provided auto dealers with >$580 million in advance payments for consumer electric vehicle (EV) tax credits since 1/1/2024. Before 2024, American car purchasers were only eligible for the new electric vehicle (EV) credit of up to $7,500 or the $4,000 credit for used EVs when they submitted their tax returns in the subsequent year.

BurklandAssociates

APRIL 30, 2024

Accountants and fractional CFOs play distinct but complementary roles in the financial management of venture-funded startups. The post Accountant vs. Fractional CFO: Choosing the Right Financial Expertise for Your Startup appeared first on Burkland.

TaxConnex

APRIL 9, 2024

The common definition of dietary supplements and vitamins is a non-food item that includes a vitamin, mineral, herb, botanical, amino acid or dietary substance. For purposes of incurring sales tax in any state, that essentially translates into “sometimes.” Sometimes a state considers supplements and vitamins as drugs, groceries or food. Sometimes these products are taxable tangible personal property, sometimes not.

Accounting Today

APRIL 24, 2024

Firms need to adapt to changes in technology at a pace that makes sense for them and their clients.

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

CPA Practice

APRIL 28, 2024

The Internal Revenue Service is offering tax-related information to entrepreneurs in anticipation of the upcoming kick-off of National Small Business Week. The U.S. Small Business Administration coordinates the annual event, helping entrepreneurs with resources, benefits and other important business startup information that small business owners can use to launch their enterprises.

Withum

APRIL 10, 2024

In a recent development that underscores the dynamic landscape of Artificial Intelligence (AI) within government, the U.S. House has blocked the utilization of Microsoft’s Copilot by its staff, representing a noteworthy chapter in the ongoing narrative of AI’s journey through the hype cycle. Just as AI approaches the summit of the Peak of Inflated Expectations, there emerges a concerted effort, notably from the media, to hasten its descent into the Trough of Disillusionment.

RogerRossmeisl

APRIL 28, 2024

In commercial litigation, it’s common for business valuation experts to measure damages based on lost profits or diminished business value — or both. Here’s an introduction to these concepts. The basics Generally, it’s appropriate to estimate lost profits when a plaintiff suffers an economic loss for a discrete period and then returns to normal. On the other hand, diminished business value is typically reserved for businesses that are completely destroyed or otherwise suffer a permanent loss, su

MyIRSRelief

APRIL 29, 2024

Los Angeles, the City of Angels, beckons with its vibrant energy, diverse culture, and endless opportunities. It’s no surprise then, that thousands of ambitious entrepreneurs set up shop in the sprawling metropolis and its surrounding cities, forming the backbone of the Los Angeles-Long Beach-Anaheim, CA (LA Metro) economy. But for these go-getters, navigating the complexities of running a business, especially the ever-challenging world of taxes and accounting, can feel overwhelming.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

TaxConnex

APRIL 4, 2024

Economic nexus thresholds in many states depend on two numbers. Now, almost six years after the landmark Wayfair case ignited sales tax obligations for more remote sellers, one of those numbers might be falling out of favor. Since the Supreme Court’s decision in 2018, almost all states with economic nexus opted to have dollar volume of sales as one trigger for sales tax obligations.

Accounting Today

APRIL 17, 2024

Diverse teams and inclusive work environments produce better results.

CPA Practice

APRIL 24, 2024

The newly formed Alternative Dispute Resolution Program Management Office, an arm of the IRS Independent Office of Appeals, will work with the agency’s business operating divisions—Wage & Investment, Large Business & International, Small Business/Self-Employed, and Tax Exempt and Government Entities—to help taxpayers resolve tax disputes earlier and more efficiently, the IRS said on April 24.

BurklandAssociates

APRIL 16, 2024

Burkland’s Fractional CFO team shares a list of cost-saving tips that venture-backed startups can employ to optimize their financial resources. The post Cost-Saving Tips for Startups: Maximize Your Cash Runway appeared first on Burkland.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

RogerRossmeisl

APRIL 28, 2024

If your business doesn’t already have a retirement plan, it might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to 20% of your self-employment earnings, with a maximum contribution of $69,000 for 2024 (up from $66,000 for 2023).

MyIRSRelief

APRIL 22, 2024

Navigating tax issues can be daunting, especially when facing audits, unpaid taxes, or payroll problems. In Corona, CA, part of the Inland Empire, taxpayers and businesses often seek clarity on resolving these issues effectively. This FAQ guide provides insights into common tax problems and solutions available in Corona, CA. 1. What is Audit Representation and How Can It Help Me in Corona, CA?

SMBAccountant

APRIL 2, 2024

It's crucial to assess your eligibility for federal grants before applying, as pursuing grants for which you are not legally eligible can waste time and resources. For small businesses, understanding various factors is essential. This includes budgeting, expense tracking, and reporting to ensure funds are used appropriately and in compliance with grant terms.

Accounting Today

APRIL 12, 2024

Some of our favorite CPAs of the silver and small screen.

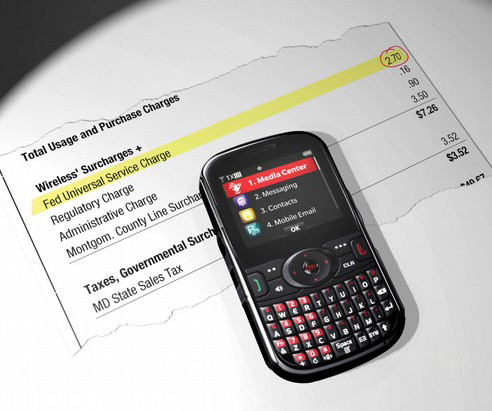

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Let's personalize your content