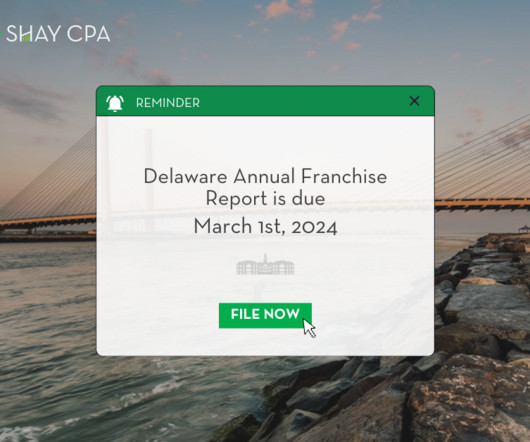

Herbein Acquires Bumpers & Co. in Delaware

CPA Practice

OCTOBER 29, 2024

has established its first location in Delaware after acquiring Bumpers & Co., team to help clients succeed with confidence in the Delaware market,” Stonesifer said in a statement. Top 200 accounting firm Herbein + Co. a Wilmington, DE-based full-service accounting and advisory firm, effective Oct.

Let's personalize your content