Why managing your accounts receivable could save your small business

Basis 365

OCTOBER 19, 2022

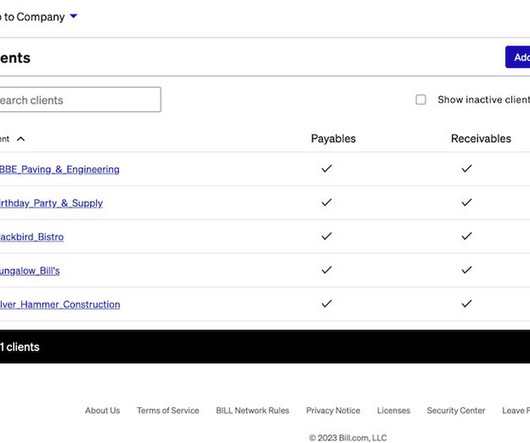

As the customer base grows, so will the need for precise financial accounting. A solid system for managing accounts will help to strengthen the monetary base, which will be the foundation of the company's advancement. Understanding the flow and ebbs of receivables can help you identify the sources of revenue that they come from.

Let's personalize your content