Implementing accounts payable best practices can help your organization reduce risk, save time and money, foster strong vendor relationships, and create a better spend culture.

You can better identify the best AP automation solution for your organization by following accounts payable best practices.

Finding a system to support accounts payable.

The project to find and onboard the right system to support your accounts payable operation requires the input of several stakeholders and a clear idea of the best-of-breed systems available to your organization.

Since everything must eventually sync to your accounting system, knowing which systems offer the best alignment with your ERP is necessary. For example, some systems sync automatically and integrate with tools like amortization schedules, custom segments, and vendor master files.

Why you need AP automation.

Once the accounts payable processes are updated, savvy finance teams can gain maximum benefit and significantly improve overall workflow efficiency and cost control within their organization. They can then focus on strategic financial analysis and decision-making instead of routine, time-consuming tasks.

Plus, the benefits of AP automation extend beyond the finance department.

The best accounts payable automation software enables seamless integration with existing systems for better collaboration between departments and stronger budget control. To maximum benefits, follow these 12 best practices!

AP Automation best practices

1) Secure stakeholder buy-in.

AP impacts employees and teams across your entire organization — it is at the core of how employees access the products and services they need to do their jobs and be productive. You won’t get the best results from your software if you don’t have full adoption.

Aligning the requirements of various stakeholders with the benefits is essential for adoption. The following steps can help:

- Start by identifying key stakeholder concerns, such as cost efficiency, increased productivity, and compliance.

- Conduct a comprehensive requirements-gathering exercise.

- Compare your requirements to the various solutions to get the greatest alignment.

- Ensure full stakeholder participation in comprehensive demos of the products on your list of candidates.

- Clearly communicate how the solution you’ve selected addresses these concerns, emphasizing specific benefits like reduced processing, error mitigation, and enhanced financial visibility.

- Arm yourself with stats — did you know our survey found that a shocking 44% of large finance teams’ time is spent on manual tasks that could be automated, like manual data entry and invoice matching?

- Tailor the message to align with each stakeholder group, showcasing how automation aligns with their specific objectives.

- Engage stakeholders early in the move to an accounts payable system. Gather their input and demonstrate how the project directly supports their goals.

2) Appoint an AP automation leader.

Appointing a competent leader to oversee the transition to new software for the accounts payable department is important for a seamless and successful transformation. A leader’s ability to communicate effectively with cross-functional teams, understand the intricacies of financial processes, and leverage technological solutions is crucial.

However, it’s important to remember that a modern, well-designed AP solution will not require a lengthy implementation.

Our customers tell us that the move to Airbase was much simpler than they anticipated. So, although a strong project leader is important, the transition shouldn’t be a heavy lift for AP departments.

3) Prompt invoice processing.

One of the key benefits of accounts payable automation software for the AP department is to speed up invoice processing, especially as companies grow and invoice volume increases.

A best practice automation strategy would, therefore, assess the invoice processing capabilities of such a system.

This can begin by understanding the points of friction in invoice processing. One survey found that 97% of finance teams waste time chasing down invoice details. Accounts payable invoice processing best practices use automated 3-way matching to speed up this process.

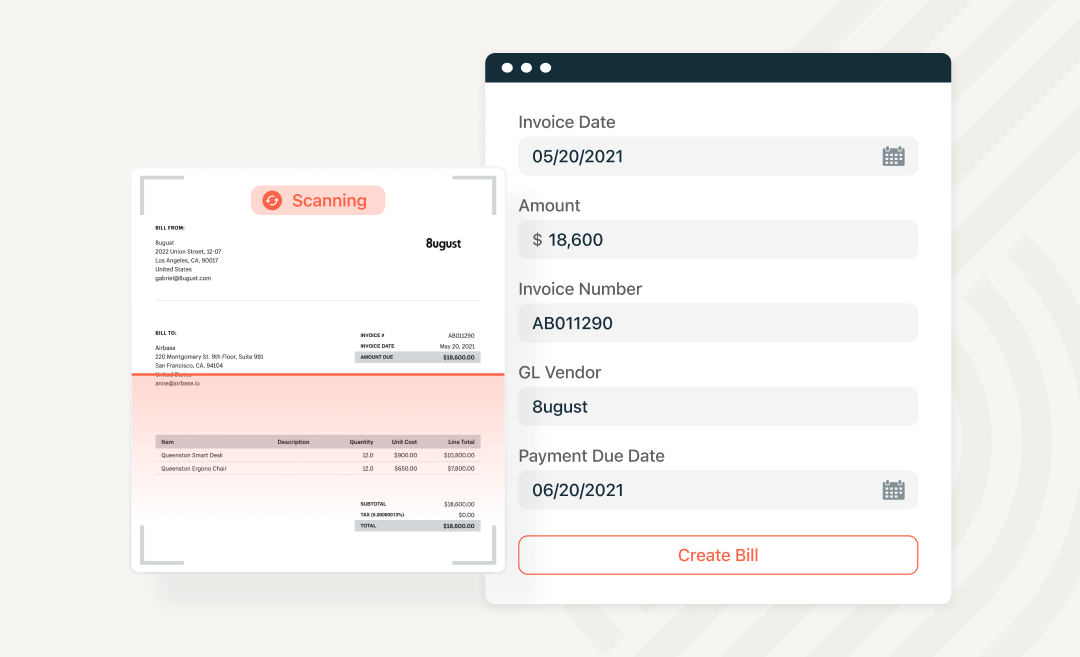

An example of processing invoices:

Automated invoice processing can help eliminate or reduce duplicate payments, reduce payment processing times, and help avoid late fees. An efficient accounts payable cycle can improve cashflow management and provide access to electronic payment methods.

Let’s take a look at how it works in Airbase with a NetSuite GL integration.

- An invoice is sent to a designated Invoice Inbox. OCR technology extracts the invoice details and pulls the accompanying email correspondence to file with the transaction for context and to create an automatic audit trail.

- The invoice is matched with the corresponding purchase order and good receipt.

- The bill is created automatically.

- The payment process starts once approved, and the transaction syncs seamlessly to the GL.

This smooth process leads to quicker identification and resolution of discrepancies, thus avoiding late or delayed payments.

For example, if the invoice amount doesn’t align with the purchase, you can deal with it right away — a contrast to the more traditional practice of bulk uploading multiple invoices.

4) An efficient implementation.

With the guidance of our onboarding team, the transition to Airbase is straightforward.

Onboarding is also your chance to do some housekeeping and clean up unhelpful GL categories, inadequate vendor records, unattributed cards, poor document management, and incomplete expense policies.

The result will be a clean and efficient setup, streamlined processes, and a new beginning. Taking the time to declutter your data during this onboarding process will pay off in the long run.

Based on our experience, every decision made throughout your Airbase implementation contributes positively to your company’s overall impact.

5) Maintain vendor communication.

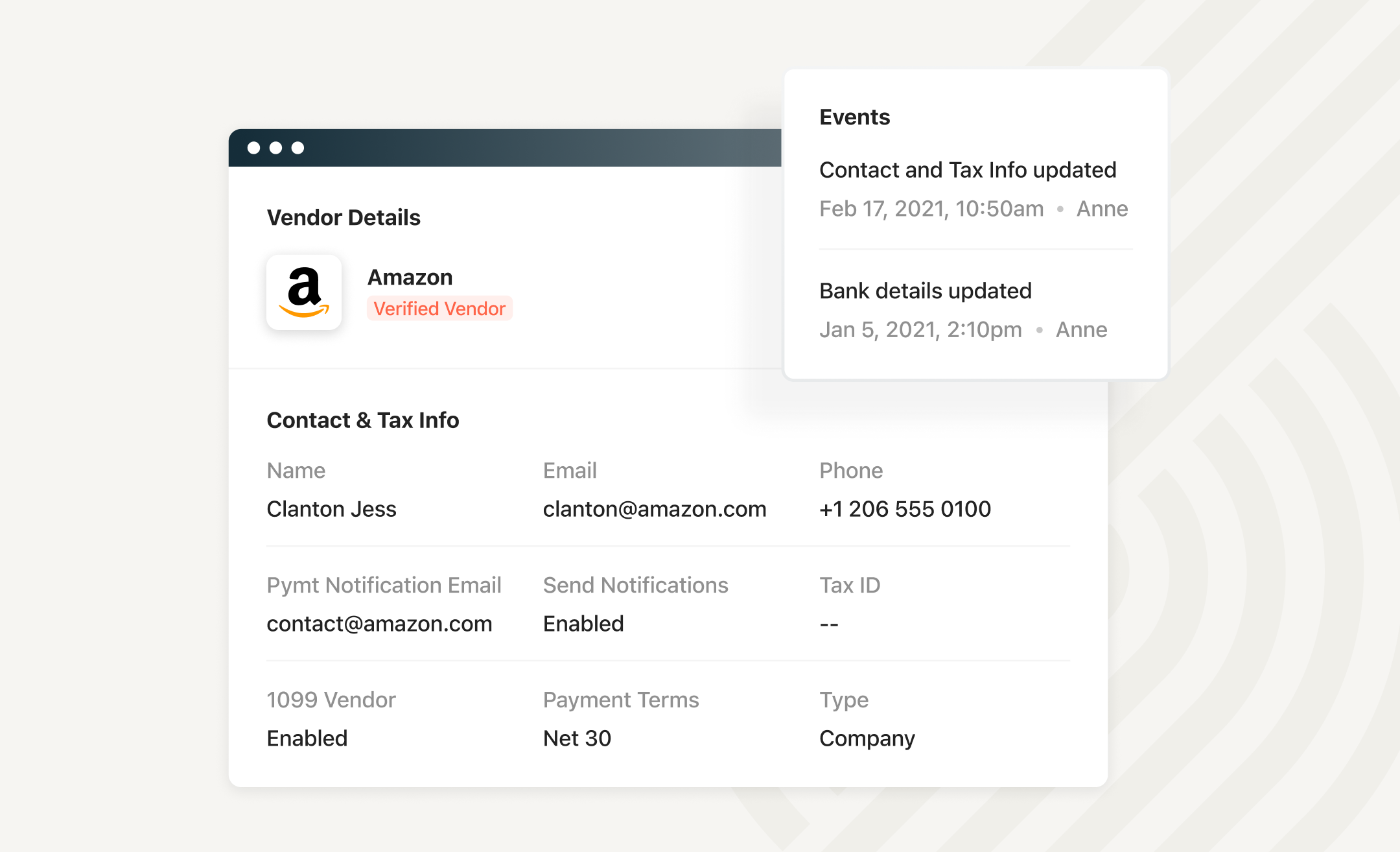

AP automation tools help maintain consistent and transparent communication between the AP department and vendors throughout the invoice lifecycle.

This transparency fosters stronger vendor relationships by ensuring all parties have access to consistent, real-time information, which reduces the risk of vendor disputes.

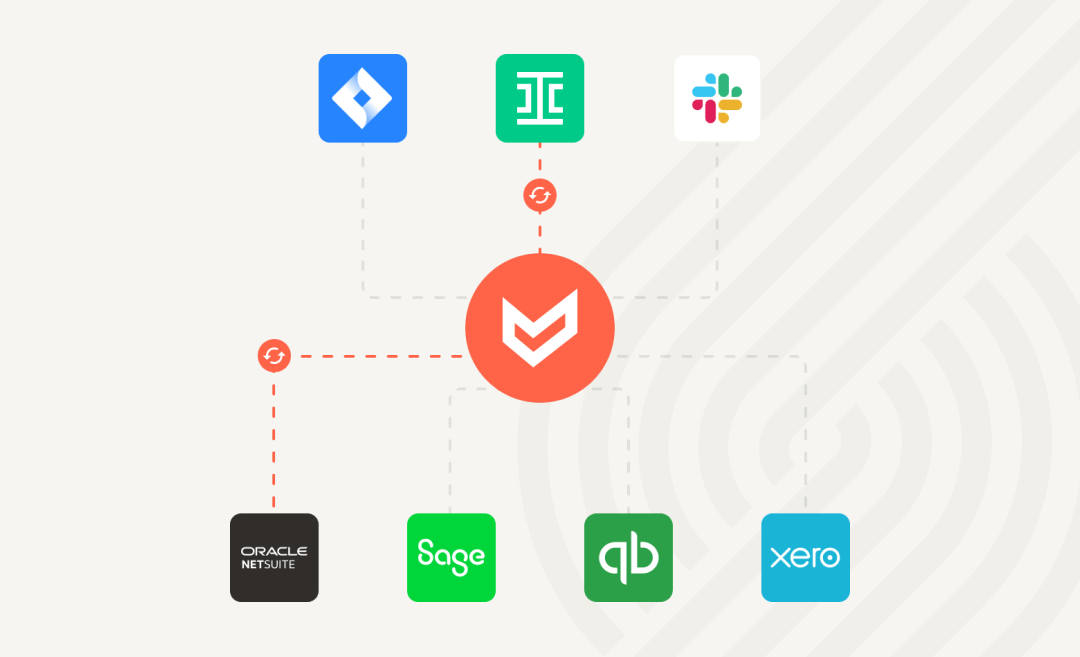

6) Seamless system integration.

Integrating AP automation software with other financial systems ensures seamless data flows and robust reporting.

When AP software integrates with broader financial systems, such as the ERP, you can eliminate data silos and base decisions on a consolidated view of cash flow, liabilities, and vendor management. All stakeholders can then make informed decisions based on real-time, accurate, and interconnected financial data.

In Airbase, an automated sync to the GL reduces the risk of manual data-entry errors and ensures consistency across platforms.

Integrations with leading HRIS systems automate the process of provisioning and deprovisioning users, and a Slack integration means you can respond to requests without leaving Slack.

Airbase’s Guided Procurement module integrates with your business systems, like Jira and Ironclad, for cross-functional visibility. This means you can track spend requests and approvals across procurement, legal, IT security, and other departments.

7) Maximize early-payment benefits.

To optimize your company’s bottom line, leverage AP automation to capitalize on early-payment discounts. It’s easy when automation streamlines invoice processing, leading to quicker approval and payment cycles.

Automated workflows help identify invoices eligible for discounts and ensure timely payment to vendors. By strategically managing payment terms, your organization can negotiate favorable discount terms. You’ll also avoid costly late payment fees.

Full visibility into company-wide spending can also help identify opportunities for savings. If many employees have the same SaaS subscription, for example, you could negotiate a multi-user discount.

8) Streamlined workflow configuration.

Assessment and mapping:

- Identify key steps in your current AP workflows, from invoice receipt to payment processing.

- Map out approval hierarchies, specifying individuals or departments responsible for each stage. Airbase’s flexible approval workflows can be easily configured to reflect your company’s policies, including approval groups and sequential or concurrent approvals.

Integration with financial systems:

- Ensure seamless integration with existing financial systems, such as ERP or accounting software.

- Establish bidirectional data flow to eliminate data entry redundancies and errors.

Document capture and validation:

- Implement optical character recognition (OCR) technology for accurate extraction of data from invoices.

- Automatically validate invoice information against purchase orders and receipts.

Exception handling:

- Create automated processes for handling exceptions, such as discrepancies or missing information.

- Establish protocols for routing exceptions to designated individuals or teams for resolution.

Mobile accessibility:

- An important element of accounts payable best practices is to ensure that the automated workflow is accessible via mobile devices to facilitate approvals on the go, improving responsiveness.

Real-time notifications:

- Enable automated notifications to alert stakeholders about pending approvals, approaching deadlines, possible duplicate payments, or issues requiring attention.

- Implement escalations for unattended tasks to prevent bottlenecks.

Audit trails and reporting:

- Audit audit trails to track changes, approvals, and actions taken throughout the AP process. In Airbase, all documentation, including email correspondence related to an invoice, is filed with the transaction record.

- Develop comprehensive reporting capabilities to gain insights into processing times, bottlenecks, and areas for improvement.

Integration with payment systems:

- Connect the AP system with payment platforms for seamless execution of approved payments.

- Configure automated payment scheduling based on terms, optimizing early-payment discounts.

Continuous improvement:

- Regularly review and analyze workflow performance and its impact on workflow operations.

- Solicit feedback from users and stakeholders to identify areas for improvement and refine the automated processes accordingly.

Early -payment discounts:

- Ensure that the finance team has transparency into the AP process before contracts are signed or payments are made. This will allow for negotiating discounts or taking advantage of purchases where they may apply.

The right system will provide insight into cashflow management.

Early notice that a large purchase order has been submitted can help the finance team plan.

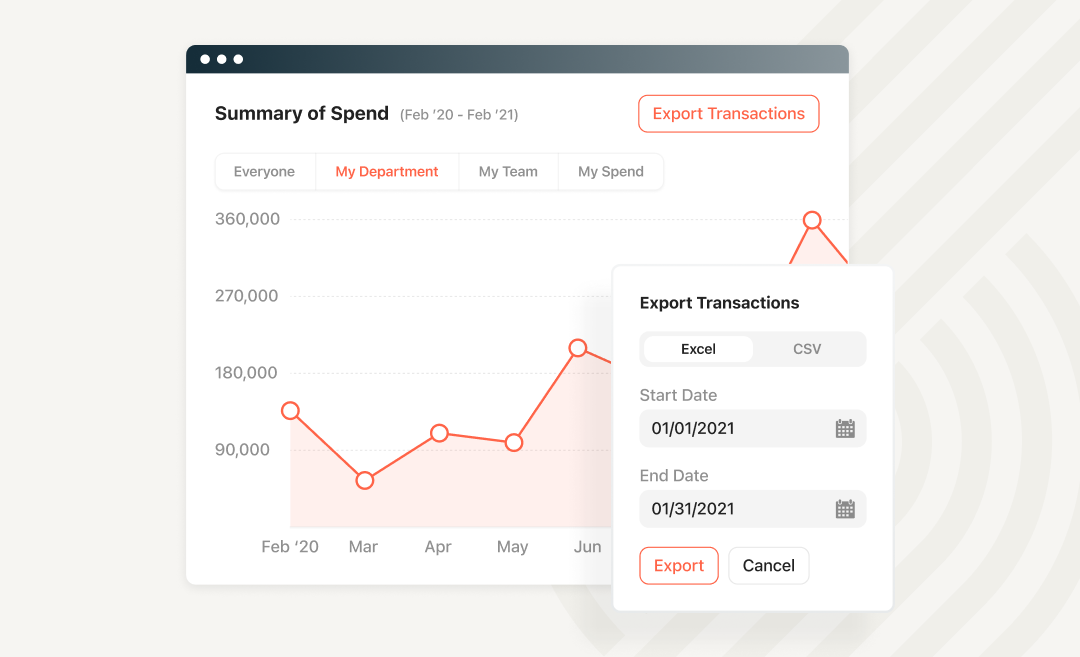

9) Leverage real-time analytics.

One of the biggest AP trends of recent years is an increased focus on data analytics — a trend that makes sense given the dramatic shifts the market has experienced. The ability to make data-driven decisions based on accurate, current data not only enhances transparency, but also helps organizations refine their financial operations for continuous improvement.

10) Enable self-service portals for vendors and suppliers.

Airbase’s vendor portal gives vendors the ability to see real-time updates on payment timelines. Automated notifications alert vendors to any discrepancies or issues for swift resolution. To prevent fraud, changes to payment details require two-factor authentication, and a vendor is alerted when changes are made. Vendors can upload information and invoices through the secure portal.

11) Enhance decision-making with analytics.

AP automation’s data analytics informs strategic business decisions and financial planning. By harnessing the wealth of data generated through automated AP processes, organizations can gain insights into spending patterns, cash flow, and vendor performance.

Armed with this data, the finance team can identify areas for cost optimization, negotiate better terms with vendors, and allocate resources more strategically. This data-driven approach helps the finance team to align their strategies with overall business objectives. Data analytics can also help reduce risk for AP teams by helping identify late payments or discrepancies.

By incorporating AP automation’s data analytics, you build resilience and agility — key elements to emerging stronger from the current downturn. And, because automation takes over the mundane tasks, AP teams have more time to focus on analysis like this. In that sense, it’s possible to leverage AP automation for career success by using this analysis to impact your organization’s bottom line.

12) Monitor essential KPIs.

Identifying and tracking Key Performance Indicators (KPIs) is crucial for measuring the success of Accounts Payable (AP) automation and ongoing process optimization. Here’s why it’s important:

- Performance measurement: By identifying the right KPIs, businesses can gauge the efficiency and effectiveness of their AP automation efforts and ongoing optimization initiatives.

- Strategic decision-making: KPIs provide valuable insights for making informed and strategic decisions related to accounts payable process improvements, resource allocation, and technology investments.

- Accounts payable process efficiency: Tracking KPIs related to process cycle times, error rates, and invoice approval times helps organizations identify areas where improvements are needed and measure the impact of automation efforts.

- Cost reduction: KPIs related to cost per invoice, cost per transaction, and overall processing costs help organizations track the financial impact of AP automation initiatives.

- Vendor and supplier relationships: KPIs related to on-time payments, early-payment discounts, and dispute resolution times can help measure the impact of AP automation on vendor relationships.

- Compliance and accuracy: Tracking KPIs related to accuracy and compliance ensures that AP processes adhere to regulatory requirements and internal policies.

- Scalability: As businesses grow, their AP processes need to scale accordingly. Monitoring KPIs helps organizations assess the scalability of their AP automation solutions and make adjustments as needed to accommodate increasing transaction volumes.

Schedule a demo

Learn more about a modern AP automation. Schedule a demo to get started.

Jira

Jira  Ironclad

Ironclad  DocuSign

DocuSign  Asana

Asana