In the world of finance and procurement, accuracy and accountability are paramount. Every organization strives to maintain a meticulous record of its financial transactions while safeguarding itself against errors and fraud. Three-way match has long been an important control measure practiced by accountants to make sure that what was purchased, what was received, and what was paid are fully aligned.

In this blog, we’ll delve into the intricacies of three-way matching, exploring what it entails and, most importantly, why it holds such a pivotal role in modern accounting and procurement practices.

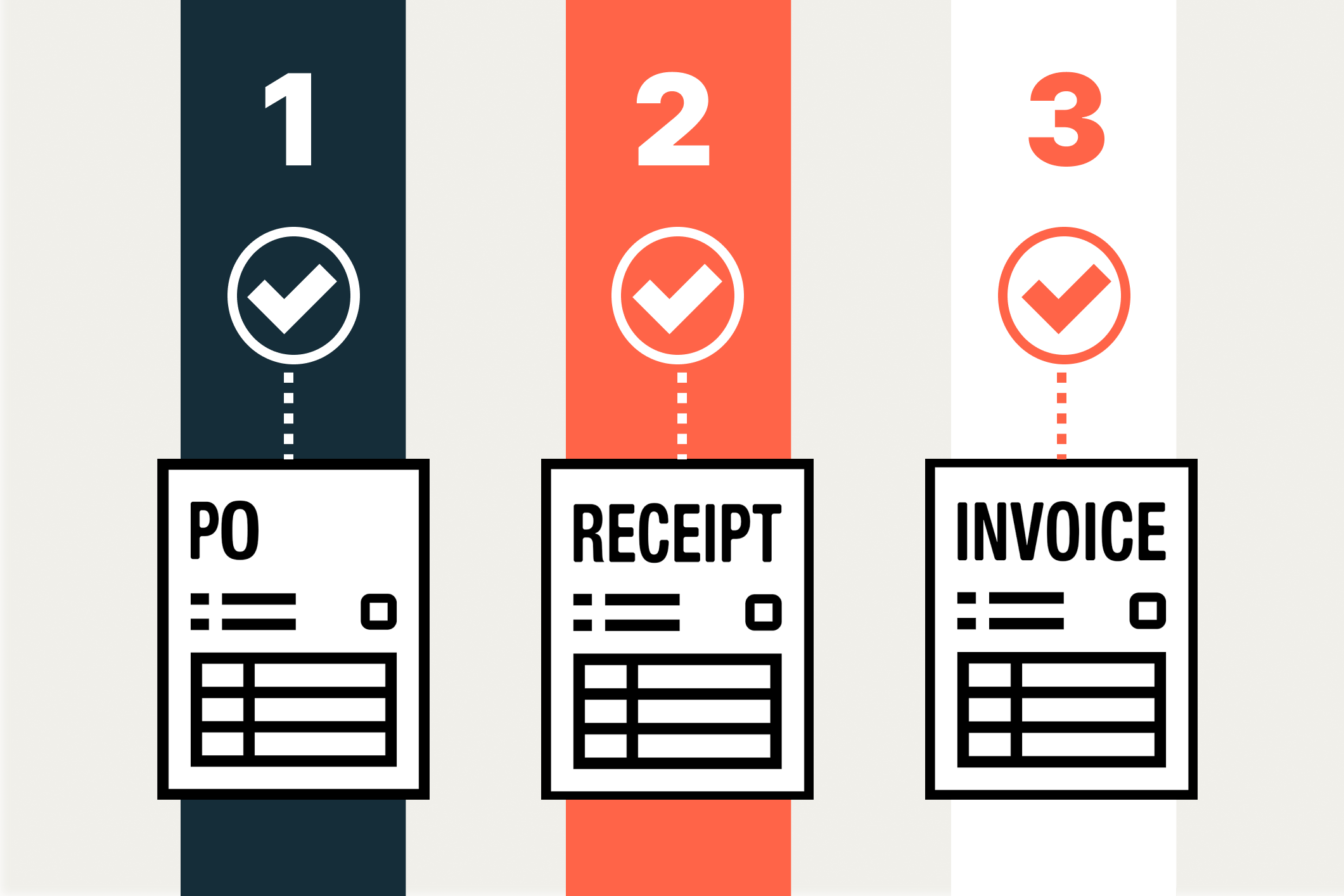

What is 3-way matching?

Three-way matching is a fundamental accounting and procurement control process that matches three critical documents related to a purchase:

- The purchase order (PO).

- The receipt of goods and services.

- The supplier’s invoice.

When all three elements match perfectly, it validates that the organization has received the expected goods and services at the agreed-upon price. This practice prevents paying for something you didn’t order, or paying more than you agreed to pay, paying for substandard goods and services, or even paying a fraudulent invoice.

When should you use a 3-way match?

Three-way match should be incorporated into accounts payable processes whenever you need to ensure the accuracy and validity of invoices — in other words, whenever possible. It’s particularly important for controlling spend and preventing unauthorized or fraudulent payments in cases where goods and services are received before payment is made.

Schedule a demo

Learn how Airbase can transform your entire purchasing process.

How 3-way matching works.

The three-way matching process follows straightforward steps that involve matching three elements of a purchase. In many organizations, this is a manual process that requires assembling all necessary documentation and verifying that the details match. These documents are:

Purchase orders.

The process typically begins with the creation of a purchase order that contains the relevant details of a purchase request, such as quantities and price. The PO is sent to the vendor or supplier so that they can create an invoice which is sent back to the purchaser, and begin fulfilling the order. Traditionally, the PO serves as a promise to purchase goods that are then sourced or manufactured by the supplier based on that PO. For service providers, the PO serves as an agreement to begin scheduling and assigning resources. At times, suppliers or vendors use the PO to obtain financing for the goods. POs are legally binding agreements between the buyer and the seller.

Goods receipt note.

When the goods or services are received, a goods receipt note is created. This confirms the goods have arrived, and verifies the quantity and condition. For services, the person ordering the services would verify that the services they received were in accordance with contract deliverables.

Supplier invoice.

The supplier sends an invoice for payment. It will contain the PO number so that it can be matched with the purchase order and receiving report to ensure everything matches the initial agreement.

If all three documents match, the invoice is approved for payment. The AP team can execute the payment with reduced risk of overpayment or unauthorized spend.

3-way matching: An example.

Let’s take a look at a company called ABC Software, who decided to return all their employees to a central office. To do so, they needed to order 50 office chairs from XYZ Office Supplies for $100 each. The following steps represent the three-way matching process.

Purchase order:

- ABC Software raises a PO that has the details of the purchase, including the quantity (50 chairs) and the agreed-upon price ($100 each). This PO is sent to XYZ Office Supplies.

Receipt of goods:

- XYZ Office Supplies ships 50 chairs to ABC Software as per the PO.

- Upon delivery, ABC Software checks the shipment and confirms that it matches the PO in terms of both quantity and condition. They generate a receiving report or goods receipt to document the receipt of goods.

Supplier’s invoice:

- XYZ Office Supplies sends an invoice to ABC Software for the 50 chairs at the agreed-upon price of $100 each.

Three-way match:

- ABC Software’s accounts payable team performs the three-way match:

- They compare the PO, which states 50 chairs at $100 each, with the receiving report, confirming that 50 chairs were received in good condition.

- Next, they compare this information with the supplier’s invoice, checking that the quantity and price on the invoice match the PO and the receiving report.

- If all three documents align (PO, receiving report, and supplier’s invoice), the invoice is approved for payment.

- If there are discrepancies, further investigation, and reconciliation are necessary before payment can be processed.

Benefits of automating 3-way matching for AP departments.

There are many benefits to three-way matching. In accounts payable, the primary benefits are:

Catch fraudulent invoices.

Three-way invoice matching acts as an internal control for fraud prevention by verifying that goods or services were actually received before paying an invoice. That prevents payment for unauthorized invoices, which is a rising problem. According to a PYMNTS survey, an alarming 98% of businesses experienced a fraud attempt in 2021!

Save time and money.

Three-way matching helps cost savings and budget efficiency by ensuring organizations only pay for the exact quantity of goods and services they received and agreed upon. The improved accuracy also saves time since AP teams can process invoices faster with fewer time-consuming discrepancies to resolve.

Improved vendor relationships.

Improved efficiency and accuracy leads to fewer late payments. The matching process helps resolve discrepancies promptly, reducing the likelihood of disputes with vendors. This in turn can lead to stronger supplier relations, potentially resulting in favorable terms, discounts, or priority access to goods and services.

3-way matching vs 2-way matching vs 4-way matching.

Two-way matching and four-way matching are also common methods used in AP to process invoices. Here’s a brief overview of the differences

Two-way matching compares the invoice with the corresponding PO. This straightforward method is commonly used for simple purchases that carry little financial risk. Although it is the fastest process, it may not catch all discrepancies.

Three-way matching adds an additional step by adding the goods receipt. This ensures that prices and quantities match and that everything was received as specified in the PO, preventing overpayments and improving accuracy.

Four-way matching adds a fourth component: a quality inspection or inspection report to verify quality and condition. This more time-consuming process is most often used in industries where quality and compliance are critical, such as manufacturing or healthcare.

The downsides of manual invoice matching.

Manually matching the components in a three-way match carries several downsides that can put accuracy and efficiency at risk. Here are three key drawbacks:

Increased chances of human error.

Everybody makes mistakes sometimes. Relying on human involvement to match invoices, POs, and receipts can raise the risk of data entry errors, misinterpretation, and accidental oversights. That in turn can make overpayments, missed payments, and discrepancies that take time to fix.

Risks of delayed payments.

Inefficient manual matching leads to payment delays, which strain supplier relationships and damage vendor relationships or disrupt supply chains. Late payments can even affect your credit rating.

More time-consuming.

What is three-way matching’s biggest drawback when done manually? For over-taxed AP departments, it’s often the amount of time spent doing tedious work when they could be doing something that adds more value to the company.

AP Automation Tour

Explore 3-way matching in our AP Automation Product tour.

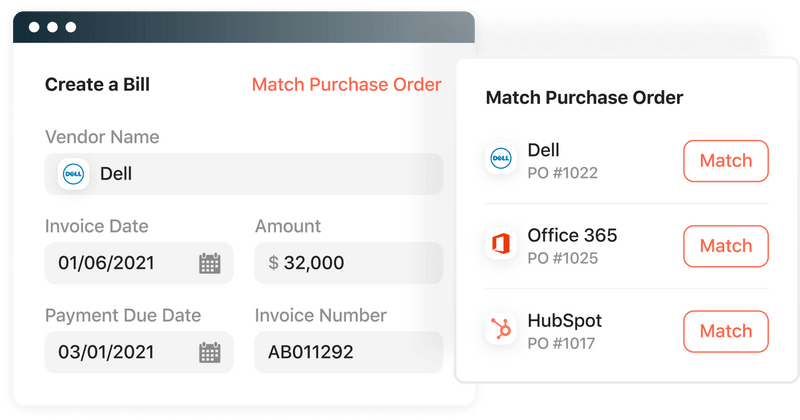

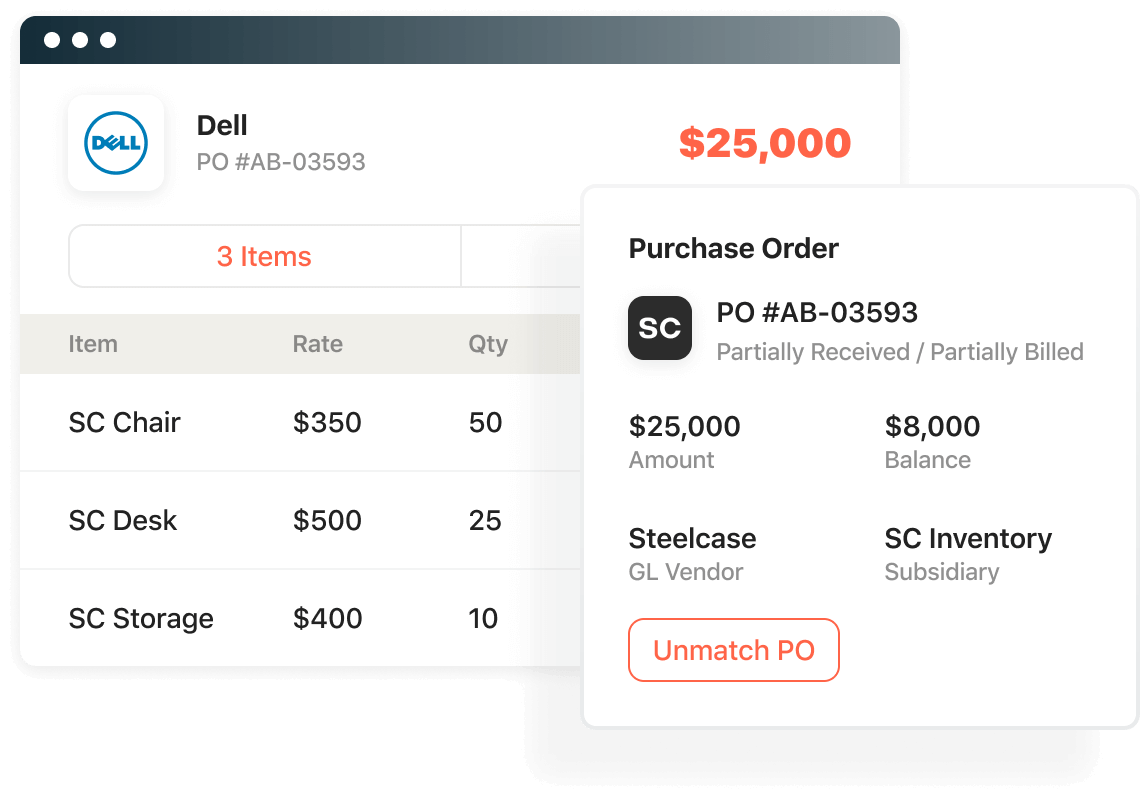

Automated 3-way matching with Airbase.

Airbase automates the three-way matching process to eliminate the downsides of invoice matching. In Airbase, POs and receipts are synced from NetSuite against an invoice received in Airbase.

Advanced OCR technology extracts the important information from invoices and highlights areas that need your attention. The result is faster bill creation, fewer errors, and speedier payments. To further streamline three-way matching, invoice processing can have set rules for exceptions so you can bill for more than the received quantity or dollar amount.

Learn more about Airbase 3-way match.

Jira

Jira  Ironclad

Ironclad  DocuSign

DocuSign  Asana

Asana