Business expense reports play a pivotal role in shaping the fiscal health and success of an enterprise. This blog explores the critical importance of these reports, delving into how they contribute to financial transparency, regulatory compliance, and the overall efficiency of business operations.

As businesses navigate the complexities of modern finance, the role of expense reports is an integral component essential to informed decision-making and sustainable growth. Let’s get started on improving your expense reporting processes!

What is expense reporting?

Business expense reports track expenses incurred by individuals within a business while performing their job responsibilities. Typically, an employee submits a business expense report to provide verification they spent money related to their job.

Expense reporting is a systematic approach to tracking, managing, and analyzing business spending. Expense reports play an important role in helping businesses maintain financial control, ensure compliance, and make informed decisions to optimize resources.

But, despite their importance, completing expense reports has long been one of the most hated tasks among employees — one study found that a majority would rather do their taxes! If you’ve ever returned from a business trip with a crumbled pile of receipts, you know that pain. And it doesn’t help that most legacy expense reporting solutions are cumbersome and slow.

Fortunately, modern expense reporting software now leverages new generative AI technology to make this often-dreaded process more accurate and much easier for employees. Let’s take a closer look at business expense reports and how your business can optimize the process.

Types of expense reports.

Expense reports can be categorized based on different business tracking needs. Here’s an overview of each category:

Monthly expense reports:

- Purpose: These reports capture all expenses incurred by employees over a one-month period.

- Suitability: Well-suited for tracking regular monthly operational expenses, such as utilities, office supplies, and subscription services.

- Benefits: Provides a comprehensive overview of ongoing monthly expenditures and facilitates budget planning.

Long-term expense reports:

- Purpose: Focuses on expenses that occur over an extended period, often spanning several months or even years.

- Suitability: Ideal for tracking major capital expenditures or projects with long-term costs, such as equipment purchases, facility renovations, or software development.

- Benefits: Offers insights into the total cost of long-term projects and helps manage cash flow over an extended timeline.

Recurring expense report:

- Purpose: Tracks expenses that repeat on a regular basis, such as monthly or quarterly subscriptions, lease payments, or insurance premiums.

- Suitability: Useful for managing fixed and predictable expenses that recur regularly.

- Benefits: Enables businesses to identify and plan for recurring financial obligations, ensuring timely payments and budget predictability.

Travel and entertainment (T&E) expense reports:

- Purpose: Travel expense reports are specifically designed to track expenses related to business travel and entertainment.

- Suitability: Essential for businesses with employees who frequently travel for work or incur entertainment expenses on behalf of the company.

- Benefits: Facilitates reimbursement for travel-related expenses such as flights, accommodations, meals, and client entertainment. Helps monitor travel budgets and ensures compliance with travel policies.

Expense Management Tour

Content of a business expense report.

Here are critical elements for an effective and compliant business expense report.

- Employee name

- Transaction date

- Merchant name

- Receipt amount

- Expense category

- Purpose

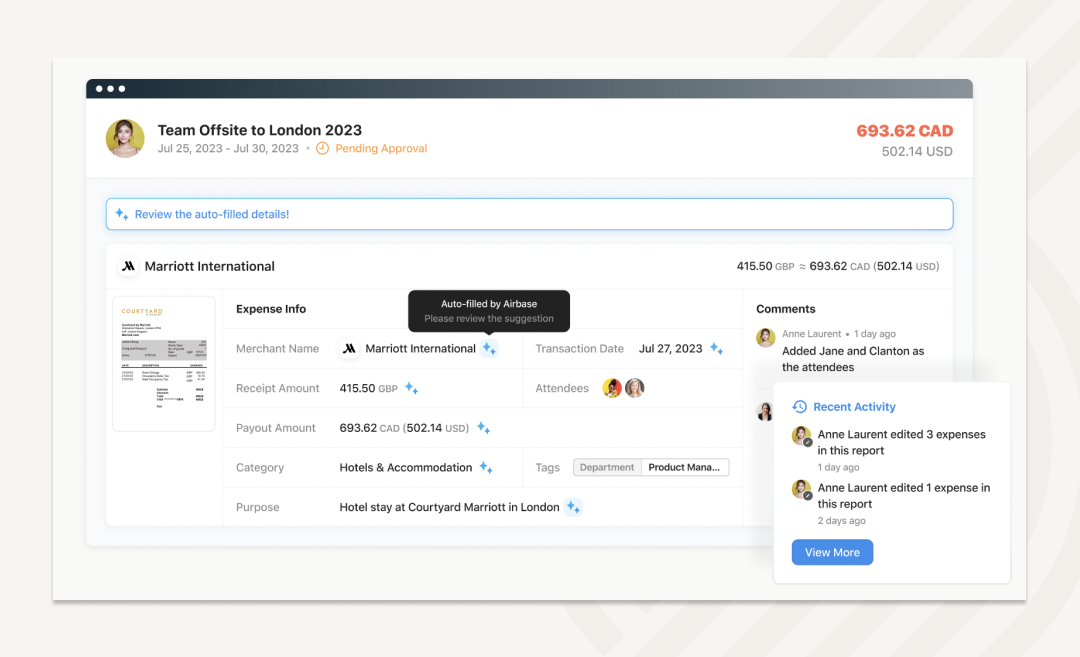

Below is an example of what an automated business expense report looks like in Airbase. Simply upload your receipt and Airbase will automatically populate your expense request details.

Steps to create effective business expense reports.

Here are some expense management tips that show how to make an expense report without adding extra work.

1) Gather and organize your receipts and expense documentation.

The traditional way of completing a business expense report involved combing through a stack of receipts to find the relevant details. Not too long ago, a blog on receipt management might have contained tips on keeping them organized for easy expense reporting at the end of a trip.

2) Using touchless expense reports.

That’s all changed now. With Airbase, you can just snap a photo of a receipt through our mobile app if you’re on the road. You can also just forward any receipt to a dedicated receipt inbox. Or, you can upload it directly into Airbase. Whichever way you choose, receipt submission is easy.

Receipts are also organized for you in Airbase. Your receipt inbox shows the status of all receipts, including the ones that were forwarded and those that were photographed via the app. It can be filtered in many different ways for ease of use.

4) Categorize your expenses for clear reporting and analysis.

Correct categorization is essential for useful reporting, but employees often don’t know which category an expense falls under. When they submit expense reports with incorrect categories, it falls to the finance team to resolve discrepancies.

In Airbase, AI and machine learning automatically categorize expenses for greater accuracy and less hassle. The system continuously becomes smarter with each transaction.

5) Use a spreadsheet or an expense management solution to create the report.

Say goodbye to wrestling with unwieldy spreadsheets and clunky expense report software to create an expense report. Airbase will assemble expense reports based on the receipts submitted.

6) Include relevant details in each expense entry for clarity and approval process.

Manually preparing expense reports raises the risk of errors — and mistakes definitely happen. According to the Global Business Travel Bureau, one in five expense reports contains an error. Using automated processes and AI reduces that risk significantly.

7) Review and validate the report for accuracy and compliance with company policies.

In the “old days” of expense reporting, you had to review an expense report thoroughly before submitting it in case your spending wasn’t compliant with your company’s business expense policy guidelines. For many of us, that created awkward moments, especially if the non-compliant purchase was already made.

In Airbase, automated approval workflows guarantee adherence to company policies. Admins can easily configure mandatory fields, set submission timeframes, and establish budget limits.

If an employee submits a request that is outside company policy, it will be flagged or blocked. This instant notification allows them to make any necessary changes to their request. Implementing automated approval workflows guarantees adherence to policies.

8) Submit the report to the appropriate department or supervisor for approval.

Another common source of confusion when it comes to expense reports is who should approve what. In a fast-moving business environment, that can change often.

Many scenarios can throw off an approval chain. It can be unclear who should approve something first. If one person is absent, a request could be stuck until they return.

Airbase takes out the guesswork with easily customized approval workflows. You can seamlessly automate the routing of approvals through one or more approvers, following any sequence that aligns with your company’s policies.

It’s also possible to delegate approval authority if you’re out of the office.

The adaptability of these workflows ensures that they can be easily adjusted to accommodate the evolving needs of your organization.

Implementing automated approval workflows guarantees adherence to your company’s policies.

Common pitfalls to avoid in expense reporting.

Lack of discipline around indirect expenses.

For a long time, finance teams faced a dilemma. Legacy procurement tools like Coupa had the discipline and control needed to manage business spending, but they were too highly engineered for mid-market to early-enterprise companies, and not geared toward a good user experience.

Procurement teams aim to achieve a high level of spend under management (SUM), and those tools made that goal possible. But SUM for indirect spend wasn’t happening with existing expense management tools.

As a result, employees weren’t sure about policies, important stakeholders were left out of the loop, and finance spent far too much time untangling the mess — looking for receipts, explaining policies, and fixing errors.

This lack of discipline can lead to a cascade of financial challenges. Without a structured approach to monitoring and controlling business expenses incurred, organizations face a greater risk of overspending, budget discrepancies, and reduced visibility.

Indirect expenses can easily spiral out of control without proper oversight — duplicate expenses and out-of-policy T&E expenses are just a couple of examples.

With a new approach to expense management software, the lack of visibility can also impede decision-making without accurate insights into business spending patterns. That makes it difficult to optimize budgets and operational efficiency.

Misclassifying expenses.

Expense misclassification can have severe repercussions for businesses.

Misclassification distorts financial reporting, leading to inaccurate insights into spending patterns and damaging the ability to make informed decisions. This can result in misguided budget allocations, impacting the overall financial health of the organization.

Misclassification may also lead to compliance issues, as expenses might be improperly reported for tax purposes or regulatory filings, exposing the business to potential penalties and legal complications at tax time.

Organizations could also miss out on potential tax deductions if an expense is in an incorrect tax category.

Inaccurate categorization can also impede the identification of cost-saving opportunities and areas for operational improvement.

Establishing precise categorization practices is essential for maintaining financial transparency, ensuring regulatory compliance, and enabling strategic financial planning within the organization.

Accurate categorization not only aids in efficient financial management but also safeguards the organization against financial risks and enhances its overall fiscal health.

Delayed submissions.

The impact of late report submissions can be significant, affecting both financial operations and personal reimbursement processes within an organization.

From a financial operations perspective, delays in submitting expense reports can disrupt the overall budgeting and forecasting processes. Late submissions also slow the timely and accurate recording of spending, making it challenging for financial teams to maintain an up-to-date and precise financial picture.

This lack of real-time data can impede the organization’s ability to make informed decisions and allocate resources effectively.

On a personal reimbursement level, late submissions can cause frustration and financial strain for employees. Delays in reimbursement may affect employees’ personal cash flow, especially if they’ve incurred out-of-pocket expenses.

This can lead to dissatisfaction among staff and potentially impact morale and productivity. Furthermore, consistent delays in reimbursement may discourage employees from adhering to expense policies, potentially leading to a breakdown in compliance.

To mitigate these issues, organizations should emphasize the importance of timely expense report submissions, implement clear policies, and leverage automated expense management systems to streamline the reimbursement process.

Encouraging a culture of accountability and implementing a seamless expense reporting process will both strengthen the financial health of the organization and the satisfaction and financial well-being of its employees.

The new era of business expense solutions.

Business expense software is evolving, with advancements in technology alleviating this historically dreaded task.

The importance of accurate categorization and streamlined reporting processes cannot be overstated, offering businesses a powerful tool for financial transparency, compliance, and efficiency.

As organizations navigate the complexities of spend management, embracing innovative solutions and fostering a culture of accountability will contribute to enhanced fiscal health and strategic decision-making.

The journey toward effective expense reporting is not only about embracing technology but also about cultivating a mindset that values precision, adaptability, and a commitment to financial excellence.

Schedule a demo

Discover Airbase’s user-friendly approach to business expense management, powered by OCR and generative AI.

Jira

Jira  Ironclad

Ironclad  DocuSign

DocuSign  Asana

Asana