Americans love talking about their favorite mom-and-pop shops. When we use the term mom-and-pop, we’re talking about a spouse-owned business. A spouse-owned business gives new meaning to “for richer and poorer” (and “till death do us part!”).

According to Harvard Business Review, three million businesses in the U.S. are spouse-owned. This type of business also makes good business and tax sense. Read on to learn how to start a business with your spouse and how you should structure your business.

How to start a business with your spouse

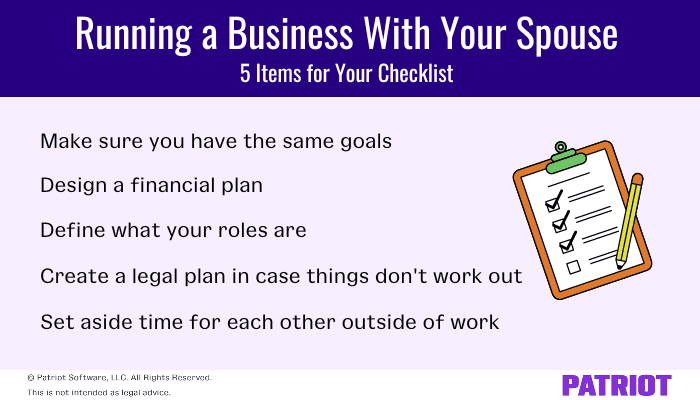

Congratulations! You’re happily married and want to go into business with your spouse. This could be a great idea, but before you put your marriage on the line, consider these five things:

- Make sure that both of you are on the same page. You two might agree on things in general, but what about the specifics of your business goals? Do you share the same vision of the future or the same desire for growth? Are both of you all in, or is someone still on the fence? Just like any decision you’ll make as a couple, you have to first make sure you’re on the same page.

- Design a financial plan. Starting a business is always a risk. Make sure that you and your spouse agree on what risks you’re willing to take. Can you use personal finances if needed to help your business? What about other assets?

- Define what your roles and responsibilities are. You and your spouse are good at different things. Get to know your skills and be honest about them. If you work together well, you’ll make a spouse-run business look easy.

- You’ve already married your business partner—don’t marry your business, too. It can be hard to turn off your brain after working hours, but your marriage may depend on it. Make the effort to disconnect from work and reconnect with the love of your life. Your business and your personal life will benefit.

Plan for the worst. In case things don’t work out, it will be easier for everyone if you make the proper plans. Consult a lawyer to determine what should happen to your business and shared finances in the event of a death or divorce.

How to organize your spouse-run business

Now that you’ve decided business life is right for you, you need to decide who owns the business and who runs operations. The answer to these questions will help you decide what type of business structure you’ll choose.

Consider these questions before you get started:

- Can you commit the same amount of time to your new business?

- Do you both have the knowledge needed to run the business?

- Do both of you want to manage the day-to-day operations of the business?

How you structure your business depends on whether the two of you are equally up to the task of running your business. It’s OK if one of you prefers to do something other than managing the business.

Whether or not you’ve decided to work as a team, you have a few options on how to structure your business:

- Sole proprietorship: Only one person can be the owner, while the other can work as an employee.

- Partnership: Two or more people own and operate a business together

- LLC: Each member would own a share of the business

- Corporation (including S and C corporations): Each spouse is a shareholder

Your tax commitments are different depending on what business structure you choose.

Going solo: Running your business as a sole proprietorship

A sole proprietorship means that one of you is running the business, while the other is considered an employee. If that’s the case:

- The owner has pass-through taxes requiring them to include business income on their personal tax return

- Employee wages are subject to income tax withholding and FICA taxes

- The employee will pay income tax based on their salary

If you decide to go with a sole proprietorship, you’ll end up with a 15.3% self-employment tax on your self-employment wages. Of this 15.3% tax, 12.4% will cover Social Security and 2.9% will cover Medicare.

But, here’s where it can get complicated. There’s a Social Security wage base, which means you stop paying the Social Security rate of 12.4% after you earn more than $147,000 in 2022. There is no Medicare wage base. Instead, there’s also an additional Medicare tax rate of 0.9% on wages you earn above:

- $125,000 (married filing separately)

- $250,000 (married filing jointly)

- $200,000 (all other filing statuses)

Keep a close watch on how the two of you are affected by the profits and losses of the business. If you realize that you share in them equally, you may be partners even without a formal partnership agreement. If this is the case, don’t report the income on a Schedule C (Form 1040). Instead, report income or loss from the business on Form 1065.

In it together: Running your business as co-owners

If you decide to run the business together, you’ll pay income tax for the business as owners:

- Partnerships, LLCs, and S corporations all have pass-through taxes, meaning that your share of the business income passes on to your income tax return. Depending on your share of the business’s income, your income tax could look different than your spouse’s. For example, if your spouse has a 70% business share, they report 70% of the business income on their Form 1040 at the end of the year. Report the remaining 30% on a separate Form 1040.

- You must also pay self-employment taxes based on your share of business income.

- Partnerships and multi-member LLCs that don’t elect to be taxed as corporations must also file Form 1065 and a Schedule K-1, annually.

- If you are part of a C Corp, you’ll have to pay tax on your dividends, and the corporation will pay tax on its income.

Partnerships and multi-member LLCs have a lot of paperwork to keep track of each year (e.g., Form 1065 and Schedule K-1). If you want your annual paperwork to be a bit easier, consider a qualified joint venture (QJV). Filing as a QJV has a few benefits:

- File only Schedule C and Schedule SE

- Both spouses get credit for taxes paid, increasing your Social Security benefits

To be considered a qualified joint venture, make sure that both you and your spouse:

- Are the only members

- Materially participate in the business

- Elect to not be treated as a partnership

File a joint return and file separate Schedule C’s to report your individual share of profits and losses.

Final thoughts

Throughout the country, the spouse-owned business is alive and well. Check out the top five states and their percentage of spouse-owned businesses:

- Idaho 35%

- Washington 32.5%

- Alaska 31.8%

- Nebraska 31.7%

- Iowa 30.7%

While some states have more spouse-owned businesses than others, it’s clear that running a business with your spouse is a popular choice. It’s up to you where and how you set up your business. No matter what, if you work together and take some time off (from the business, not each other!), your business and marriage will prosper.

This is not intended as legal advice; for more information, please click here.