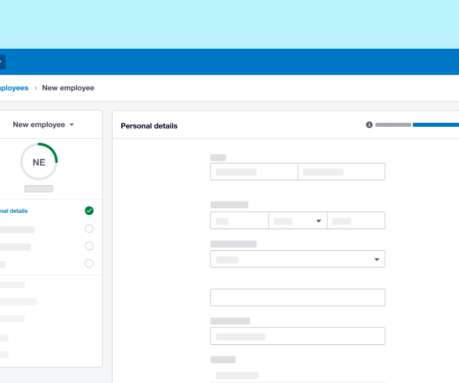

Four steps to a seamless payroll year end with Xero Payroll

Xero

MARCH 10, 2024

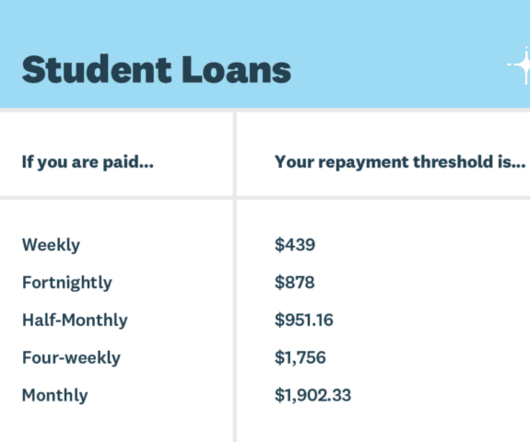

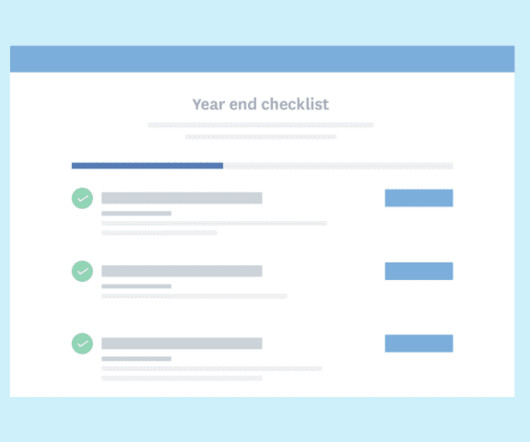

As the summer days become a memory, it signals the onset of a crucial period for payroll professionals in New Zealand. With the approaching new tax year on 1 April 2024, regulatory changes are set to impact payroll calculations across the country. There should be nothing else you need to do to finalise payroll year end.

Let's personalize your content