Choosing the Right Accounting Software

SMBAccountant

JANUARY 5, 2024

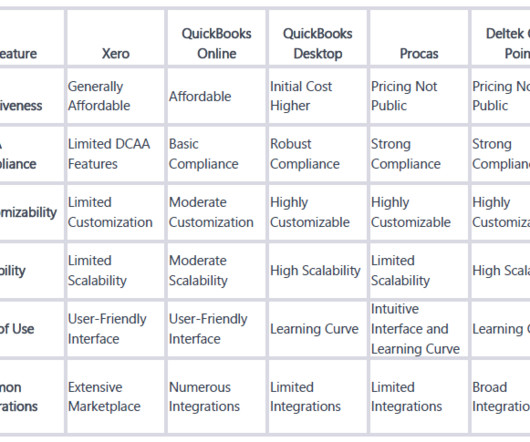

The beginning of a new year also means a fresh start for your Income Statement; which is why now is the perfect time to review your accounting software needs. That's why most firms use invoicing and accounting software. Additionally, bookkeeping is simplified with accounting software. Does it need to have a FedRAMP designation?

Let's personalize your content