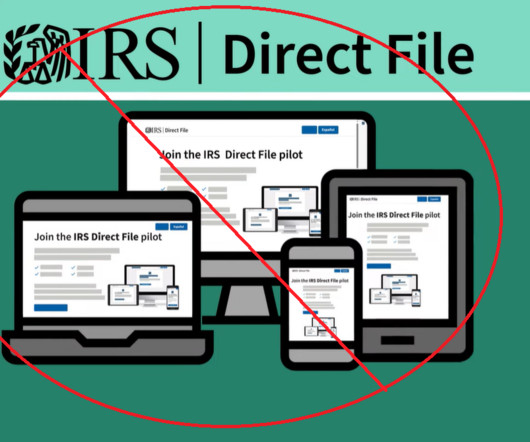

COUNTERPOINT: IRS Should Not Be Trusted With Direct File

CPA Practice

APRIL 11, 2024

The IRS estimates Direct File to cost $64 million to $249 million annually, which seems wildly low. In 2021, researchers at Govini analyzed Direct File’s likely price tag against the experience of Healthcare.gov, concluding that the former’s costs would dwarf the latter’s. This lacuna elicits no confidence in the IRS’s figures.

Let's personalize your content