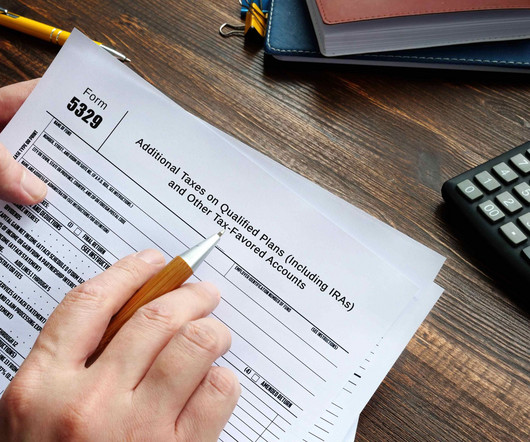

IRS Form 5329: What it is and how to complete it

ThomsonReuters

APRIL 25, 2024

For accountants, you must also remind your clients that early distributions from qualified retirement plans or other tax-favored accounts may incur penalties and trigger the need to file Form 5329 – Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts. Jump to: • What is Form 5329?

Let's personalize your content