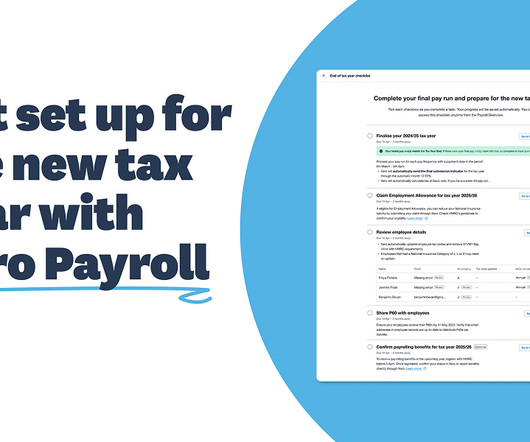

Your ultimate payroll year-end 2024/25 checklist: steps and deadlines

Xero

DECEMBER 17, 2024

Whether youre a seasoned payroll manager or doing it for the first time, payroll year-end can be tricky. Make sure you have the right, complete information so you dont need to make adjustments after submitting. Now, more than any other time in the year, is the time to know exactly who is on the payroll.

Let's personalize your content