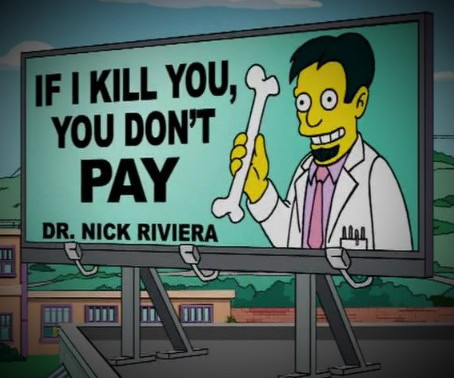

Client That Fired Marcum Over Audit Quality Compares the Firm to a Doctor Killing 25-50% of His Patients

Going Concern

JULY 13, 2023

Concerns over the reputation and legal troubles surrounding the audit firm Marcum LLP have led members of the Chariho School Committee to terminate its contract, moving in a different direction for the first time in 18 years. It may be called The Westerly Sun but this paper is throwing nothing but shade at Marcum.

Let's personalize your content