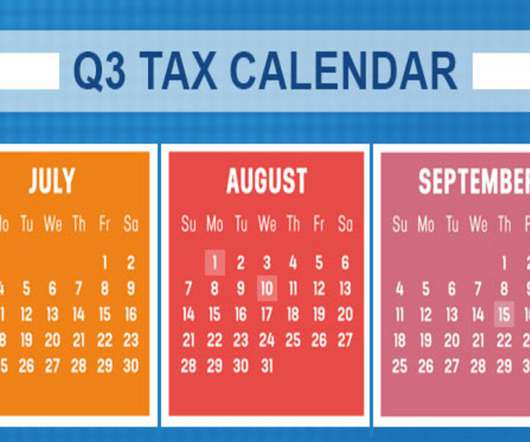

2022 Q3 Tax Calendar for Businesses and Other Employers

RogerRossmeisl

JULY 16, 2022

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. August 1 Report income tax withholding and FICA taxes for second quarter 2022 (Form 941), and pay any tax due.

Let's personalize your content