How To Download Your IRS Account Transcript to Look Up Your Estimated Tax Payments (Updated Jan 2024)

Nancy McClelland, LLC

JANUARY 16, 2024

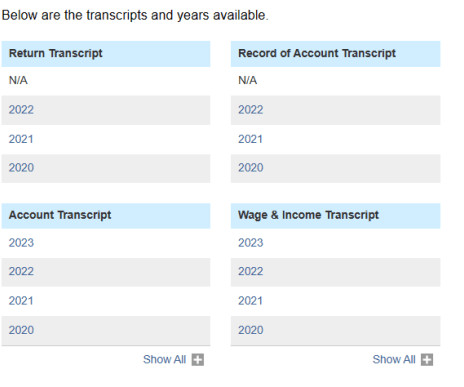

Photo by Thomas Lefebvre “What is an IRS Account Transcript and Why Do I Need One?” ” During the pandemic, we began requiring all clients to submit a copy of their IRS Account Transcript along with their Tax Organizer and other annual tax prep documentation. account, the ID.me

Let's personalize your content