What Is AP Automation and How Can It Help Your Business?

Accounting Seed

AUGUST 5, 2025

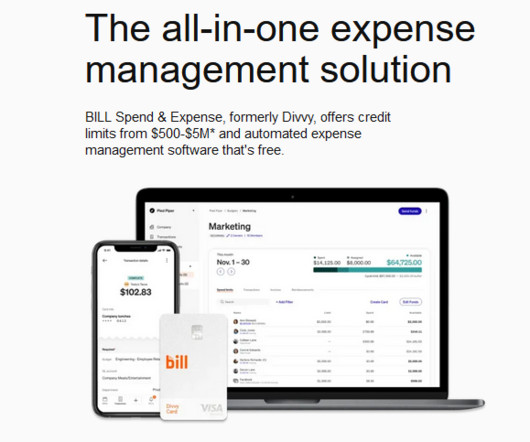

Accounts Payable (AP) automation is the use of technology to digitize and optimize the invoice-to-payment process within an organization. “There’s a big reporting and analytics benefit here,” adds Shannon Canzanella , Manager at Accounting Seed. ” While 63% of U.S.

Let's personalize your content