Tax Season to Start January 29, 2024

CPA Practice

JANUARY 8, 2024

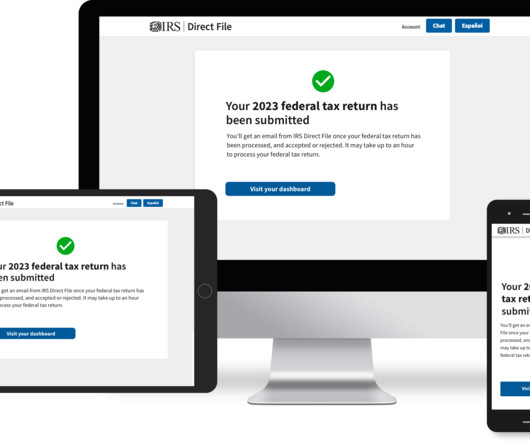

An enhanced IRS Individual Online Account that includes chat, the option to schedule and cancel future payments, revise payment plans and validate and save bank accounts. Taxpayers living in Maine or Massachusetts have until April 17, 2024, due to the Patriot’s Day and Emancipation Day holidays. Where’s My Refund?

Let's personalize your content