Bookkeeping Fundamentals for Small Business Owners

DuctTapeMarketing

JULY 14, 2018

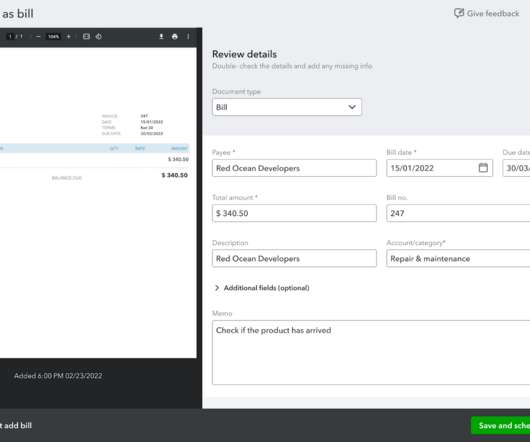

Handle payments and manage accounts payable. Prepare the books for tax season. Setting up your chart of accounts to be tax-ready from the start will help you with tax saving opportunities and help you prepare for your tax liabilities, with no surprises. Delegate what you can.

Let's personalize your content