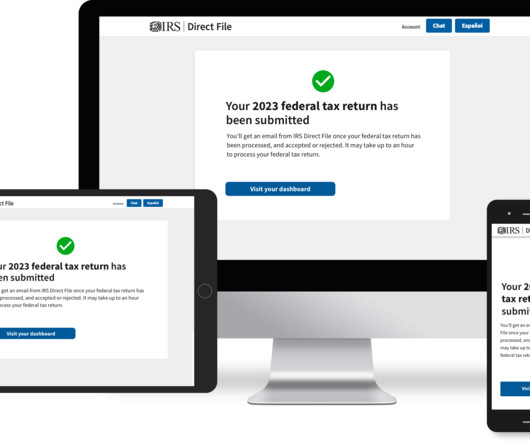

IRS Direct File Launches for Low-Income Taxpayers in 12 States

CPA Practice

JANUARY 29, 2024

It’s back to regular IRS deadlines this year, but with a new tool for many low- and moderate-income households: a service that will prepare and file their tax returns online for free. If you’re entitled to a refund, tax experts say, you should file your return as soon as possible. Who will have access to Direct File?

Let's personalize your content