Tax Partner Matters More Than Firm on Business Taxes

CPA Practice

AUGUST 23, 2023

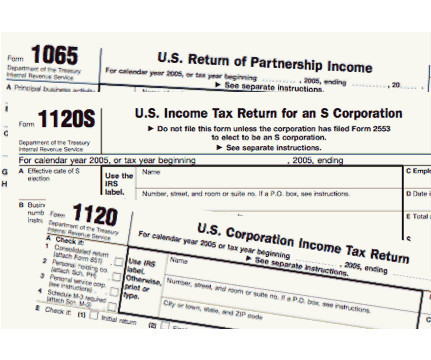

“We asked ourselves why some corporations pay more taxes and some pay less,” said Jaron Wilde, associate professor of accounting. Wilde’s team analyzed more than 94,000 tax returns of U.S. businesses with at least $10 million in assets that used an external tax preparer between 2005 and 2016.

Let's personalize your content