Tax Preparers Rejoice! Here’s How To Prepare SECURE 2.0 Form 8881 Retirement Tax Credit If You Use Gusto & Guideline

Nancy McClelland, LLC

APRIL 5, 2024

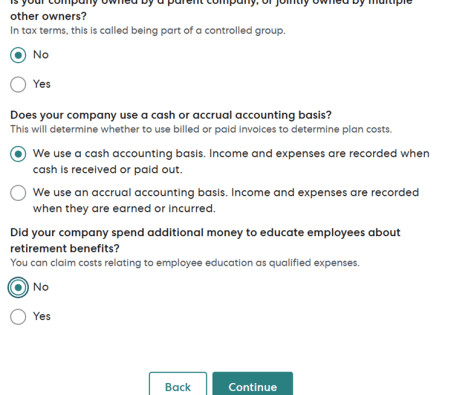

As a CPA whose company works with loads of small businesses that need to process payroll, I’ve used quite a few payroll systems through the years… and Gusto has become our favorite. Honestly, I randomly stumbled on it when I went into my own Gusto account to run weekly payroll.) Review it carefully.

Let's personalize your content