From Chaos to Order: How to Improve Workflow & Client Communication

Canopy Accounting

MARCH 7, 2025

From elevating client communication to improving workflows, this guide will help you turn chaos to order.

Canopy Accounting

MARCH 7, 2025

From elevating client communication to improving workflows, this guide will help you turn chaos to order.

Withum

MARCH 7, 2025

Vacation ownership resorts operate in a unique segment of the hospitality industry, requiring solid financial management to ensure sustainability, profitability and guest and owner satisfaction. Effective budgeting and financial reporting are crucial for these entities to manage their resources efficiently, meet regulatory requirements, and provide transparency to stakeholders.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nancy McClelland, LLC

MARCH 7, 2025

Tax seasonthat special time of year when caffeine consumption triples, restful sleep becomes a scavenger hunt, and your spouse and friends begin to question your sanity. If youre deep in the trenches of tax filings, bookkeeping clean-ups, and client questions that couldve-been-Google-searches, you know the struggle is real. But after 23 years, I feel like Im finally finding my groove and because I dont want it to take you as long to figure out as it did me, Im sharing tips and tricks that have b

Going Concern

MARCH 7, 2025

We See You, #TaxTwitter Have you reached the eye twitch part of tax season yet? — Logan Graf (@LoganGrafTax) March 6, 2025 Consulting Trump administration to expand blitz against spending on consultants [ Financial Times ] An FT analysis of federal data shows that more than 30 contracts held by the 10 consultants have been completely or partially cancelled.

Advertisement

The office of the CFO is rapidly evolving, with more and more demands being placed upon the finance and accounting team each year. Join us in this webinar, where we share 8 things to NOT do when it comes to helping the CFO office advance in supporting the business. Learning Objectives: This course objective is to understand how best to support an organization's finance leadership.

Ronika Khanna CPA,CA

MARCH 7, 2025

As a small business owner and content creator, I’m always looking for resources that will help me improve my own business, and provide insight into the latest developments, innovations, tools and guidance on financial and tax matters. Over time, I have bookmarked a list of the resources that I visit frequently: 1. Canada.ca – Business and Industry The federal government’s main business portal covers starting, financing, managing, and growing your business.

Randal DeHart

MARCH 7, 2025

Navigating the world of finances can sometimes feel like trying to build a house without a blueprint. Between managing budgets, keeping track of expenses, and ensuring you're compliant with tax regulations, it's easy to feel overwhelmed. That's where your financial dream team comes in! Having the right people by your side can make all the difference in staying organized and achieving your business goals.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Randal DeHart

MARCH 7, 2025

Understanding and managing your gross profit margin is crucial to ensuring the sustainability and profitability of your business as a construction contractor. This key financial metric not only reflects your company's financial health but also helps guide your pricing strategies, project management decisions, and overall strategic planning. Profit is the money left in your business after all your expenses have been paid.

Accounting Today

MARCH 7, 2025

Everyone knows tax pros don't make mistakes, but it can't hurt to doublecheck for these mistakes before filing.

CPA Practice

MARCH 7, 2025

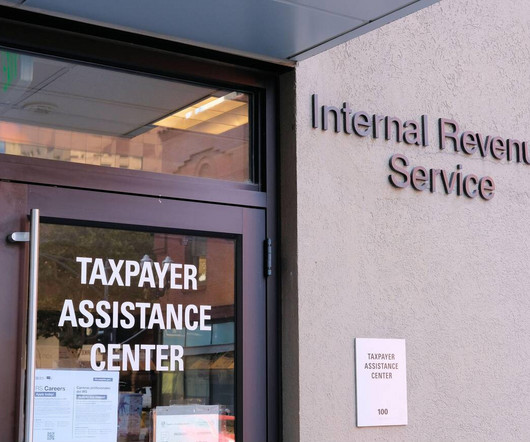

In the wake of recent reports of workforce reductions at the Internal Revenue Service (IRS), President and CEO, Mark Koziel, CPA, CGMA, of the American Institute of CPAs (AICPA) released the following statement.

Patriot Software

MARCH 7, 2025

Youve heard about debits and credits. You know they increase and decrease certain accounts. But, how much do you know about the accounts they affect? There are five types of accounts in accounting. If you dont know what they are, your crash course has arrived.

Speaker: Dylan Secrest, Founder of Alamo Innovation and Construction Digital Transformation Consultant

Construction payment workflows are notoriously complex when you consider juggling multiple stakeholders, compliance requirements, and evolving project scopes. Delays in approvals or misaligned data between budgets, lien waivers, and pay applications can grind progress to a halt. The good news? It doesn't have to be this way! Join expert Dylan Secrest to discover how leading contractors are turning payment chaos into clarity using digital workflows, integrated systems, and automation strategies.

CPA Practice

MARCH 7, 2025

For the second consecutive year, individual contributionsthe single largest source of dollars given to charitable organizations for more than 10 yearshave declined.

Insightful Accountant

MARCH 7, 2025

In this episode of Accounting Insiders, host Gary DeHart talks with Randy Crabtree, CPA & co-founder of Tri-Merit Specialty Tax, about the Bridging the Gap Conference (July 22-24, 2024, Denver).

CPA Practice

MARCH 7, 2025

Even though the Tax Court is commonly thought of as the forum of last resort for appealing tax bills and other IRS issues, there is a way to appeal a Tax Court ruling. However, the chances of success of these appeals are often relatively low.

Accounting Today

MARCH 7, 2025

Panelists at today's Schellmancon event said that last year saw a great increase in AI oversight, governance and regulation, and that this trend will likely not only continue but accelerate this year.

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

CPA Practice

MARCH 7, 2025

A federal jury convicted a Michigan businessman on March 5, 2025, for not paying employment taxes and not filing his own individual income tax returns.

Accounting Today

MARCH 7, 2025

The Securities and Exchange Commission's new EDGAR system will go live on March 24.

CPA Practice

MARCH 7, 2025

The Tax Blotter is a round-up of recent tax-related news briefs.

Ronika Khanna CPA,CA

MARCH 7, 2025

With all data moving to the cloud these days and ubiquitous online access to banking, customer and supplier portals, it makes sense that Revenue Canada (CRA) and Revenue Quebec (RQ) have followed suit. Considerable resources have been spent by the revenue agencies on developing their online portals and encouraging both individual taxpayers and businesses to move the majority of their tax related interactions online (almost every accountant conference has an appearance by a CRA representative tal

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

Accounting Today

MARCH 7, 2025

The American Institute of CPAs is monitoring the situation at the IRS amid reports of heavy layoffs, stressing the need to maintain services during tax season.

Insightful Accountant

MARCH 7, 2025

RightNOW25, hosted by Rightworks, is set for its second annual conference in Nashville, TN. This event, beginning May 19, 2025, offers a unique opportunity to dive deep into the latest trends and technologies in the accounting profession.

Accounting Today

MARCH 7, 2025

Plus, Xero debuts "reconcile period" feature; EisnerAmper appoints David Frigeri as chief artificial intelligence officer; and other accounting tech news.

Insightful Accountant

MARCH 7, 2025

Join Janel Sykora and earn CPE credit as she discusses the top 5 marketing mistakes accounting firms make (and how to fix them).

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

Accounting Today

MARCH 7, 2025

KPMG elects next CEO and opens first Big Four-owned U.S. law firm; EisnerAmper names chief artificial intelligence officer; and more news from across the profession.

FraudFiles

MARCH 7, 2025

Winning a case against an auditing firm when there is a sizeable fraud (such as the Koss Corp. embezzlement) or the collapse of a Ponzi scheme (such as the Bernie Madoff case) is not easy. Simply because there is a fraud, a business failure, or a pyramid scheme collapse, the auditors are not necessarily at [.

Accounting Today

MARCH 7, 2025

Forecasting fiscal stability in municipalities is increasingly critical as public entities face unprecedented financial challenges.

Ace Cloud Hosting

MARCH 7, 2025

With the ever-changing digital landscape, we are more interconnected than ever before. Nowadays, ensuring that your business has robust cybersecurity is no longer an option; it’s a must. Therefore, businesses.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

CPA Practice

MARCH 7, 2025

In this video and podcast, Randy Johnston and Brian Tankersley, CPA, discuss the Crypto Summit held at the White House on March 7, 2025, and the potential effects for accounting, reporting, taxes and accounting firms.

Accounting Today

MARCH 7, 2025

The Trump administration's move will only increase the opportunities in helping manage and audit crypto holdings.

CPA Practice

MARCH 7, 2025

The Trump administration recently announced that it is halting all enforcement actions tied to the Corporate Transparency Act; however, small businesses are not out of the woods yet.

Accounting Today

MARCH 7, 2025

The agency nixed controversial staff crypto accounting guidance, which interim chief Mark Uyeda described as overstepping the normal procedures.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Let's personalize your content