Filing trends to watch during the 2025 tax season

Accounting Today

FEBRUARY 13, 2025

As the new year's tax season begins, a look back at lessons from the 2024 filing season.

Accounting Today

FEBRUARY 13, 2025

As the new year's tax season begins, a look back at lessons from the 2024 filing season.

BurklandAssociates

FEBRUARY 11, 2025

Avoid payroll pitfallslearn the essential taxes every startup must pay and how to stay compliant with IRS and state regulations. The post Payroll Taxes for Startups: What Do I Have to Pay? appeared first on Burkland.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CPA Practice

FEBRUARY 5, 2025

New data from theNational Student Clearinghouse Research Centershows a12% increase in fall 2024 accounting enrollment compared to fall 2023. The increase amounted to an additional 28,672 students.

CPA Practice

FEBRUARY 3, 2025

Through my experience speaking with accounting students and reflecting on my own journey, Ive identified five key areas where we can bridge the gap between education and practice.

Advertisement

The office of the CFO is rapidly evolving, with more and more demands being placed upon the finance and accounting team each year. Join us in this webinar, where we share 8 things to NOT do when it comes to helping the CFO office advance in supporting the business. Learning Objectives: This course objective is to understand how best to support an organization's finance leadership.

AccountingDepartment

FEBRUARY 19, 2025

Accounting disruptions can strike without warning. Whether its a provider suddenly shutting down, platform glitches, or other unforeseen issues, these disruptions can leave your business scrambling. With cases like the sudden closure of Bench, which left businesses without their books, its more apparent than ever that entrepreneurs and business owners need a plan to safeguard their financial processes.

Ryan Lazanis

FEBRUARY 20, 2025

Save time and effort with accounts receivable automation - the powerful solution to automate a manual accounting process. Learn more here! The post Accounts Receivable Automation: The Complete Guide appeared first on Future Firm.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

ThomsonReuters

FEBRUARY 4, 2025

Jump to Key areas where AI enhances tax services in large firms Barriers to AI adoption in large firms and overcoming them Embrace AI in your large firm for a competitive edge The tax and accounting industry is on the brink of a significant transformation, driven by the integration of artificial intelligence (AI) and generative AI (GenAI). The 2024 Tax Firm Technology Report highlights that 93% of large tax and accounting firms are either actively using, exploring, or considering AI technologie

Patriot Software

FEBRUARY 27, 2025

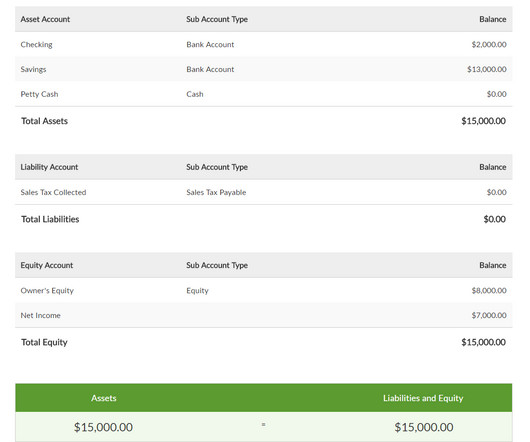

One of your first choices as a business owner is your accounting method. Before making a decision, take some time to compare the cash-basis vs. accrual basis methods of accounting. Having to switch from cash-basis to accrual-basis after the fact can be difficult.

GrowthForceBlog

FEBRUARY 21, 2025

8 min read February 21st, 2024 For many small and medium-sized enterprises (SMEs), the end of the fiscal year coincides with the end of the calendar year. This means it is time for financial leaders to begin closing the financial books. Key Takeaways Reconcile Transactions and Accounts: This step in the process can be tedious because you have to look through minute details while paying exceptional attention to detail.

Going Concern

FEBRUARY 3, 2025

Hot off Ohio’s governor signing into law a bill that introduces a bachelor’s only pathway to CPA licensure in that state , a pair of Illinois representatives have introduced a bill that would do the same for aspiring CPAs in their state. And the Illinois CPA Society is cheering it on. They should be, they helped it come together. The details from the ICPAS press release : Today, ICPAS is incredibly pleased to have Reps.

Speaker: Dylan Secrest, Founder of Alamo Innovation and Construction Digital Transformation Consultant

Construction payment workflows are notoriously complex when you consider juggling multiple stakeholders, compliance requirements, and evolving project scopes. Delays in approvals or misaligned data between budgets, lien waivers, and pay applications can grind progress to a halt. The good news? It doesn't have to be this way! Join expert Dylan Secrest to discover how leading contractors are turning payment chaos into clarity using digital workflows, integrated systems, and automation strategies.

Withum

FEBRUARY 21, 2025

The regulatory landscape is constantly evolving, and cybersecurity is no exception. You may have heard that under the new administration, regulation was going to be reduced or that there was a pause in enforcement actions, e.g. FCPA. These pauses are temporary and intended for the agencies involved to revise their approach to be efficient and effective.

Xero

FEBRUARY 3, 2025

I remember watching Back to the Future as a kid and looking forward to the future it predicted. Flying cars! Hoverboards! But here we are, 10 years after the movies timeline, and I still need roads wherever Im going. It turns out that predicting the future is hard. Really hard. Particularly when trying to do so on an accurate timeline. But that doesnt mean we cant spot signals and patterns emerging today that hint at whats to come.

Shay CPA

FEBRUARY 19, 2025

Growing a startup comes with a potentially heady mix of near-endless opportunities surrounded by countless pitfalls. While the freedom that comes with scaling up the business is exciting, sometimes its nice to know youre on the right track as verified by outside sources. Enter: a financial audit. This tool gives you a way to validate that your company is following proper accounting practices and that your books are accurate.

VJM Global

FEBRUARY 17, 2025

Held by the Honble High Court of Andhra Pradesh In the matter of Tirumala Balaji Marbles And Granites vs. the Assistant Commissioner St and Others (W.P.No.1200/2025) The Petitioner applied for GST registration in the state of Andhra Pradesh. However, the proper officer rejected the application because the applicant and the authorized representative do not belong to the state of AP.

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

ThomsonReuters

FEBRUARY 6, 2025

In the fast-paced world of accounting and tax preparation, every minute counts. As an accountant or CPA, youre often juggling multiple clients, deadlines, and tasks, which can lead to overwhelming stress and burnout. According to the 2024 State of Tax Professionals Report , time management, meeting deadlines, and timely filing were the second highest set of challenges for survey respondents.

CTP

FEBRUARY 24, 2025

The rise of remote work has impacted the majority of industries across the U.S. The Bureau of Labor Statistics found that between 2019 and 2021 the percentage of remote workers rose from less than 17% to over 39% among professional, scientific, and technical servicesincluding tax professionals. Adopting remote working practices comes with both advantages and disadvantages: how can you communicate well across geographies and time zones and make sure the client gets the best product?

Withum

FEBRUARY 19, 2025

For automotive accountants and CFOs, the AICPA Dealership Conference is the ultimate destination to connect with industry contacts, clients, and fellow accounting firms to discuss the latest hot topics and trends for the current and upcoming year. We at Withum look forward to attending year after year and highly recommend this event to our clients, banking partners, and other accounting firms.

Menzies

FEBRUARY 17, 2025

Menzies LLP - A leading chartered accountancy firm. What is the trading allowance? The trading allowance is a tax-free allowance of up to 1,000 per year for any trading or casual income sources. Sometimes referred to as the hobby allowance, the trading allowance is great for people who are just starting out a trade or receive small revenues for small gigs such as occasional dog walking.

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

Shay CPA

FEBRUARY 12, 2025

On the surface, bookkeeping might not seem that complicated. A client or customer pays you money, so you record it on your books on the date it was paid. Right? Wrong. Because of the Financial Accounting Standards Boards (FASBs) Accounting Standards Codification (ASC) 606 , its mandated that companies use whats called revenue recognition. This means only putting something on your books as revenue as youve actually earned the money.

Going Concern

FEBRUARY 24, 2025

On average 56 minutes a day, or 18 hours a month , according to the 2025 State of AI in Accounting Report by Karbon. Who’s working just 18 days a month? Good for them. Karbon said: On average, accounting professionals save 56 minutes a day (a potential of 18 hours a month) with AI, with over a third (38%) of this time spent on communication tasks like drafting emails and managing correspondence.

Acterys

FEBRUARY 19, 2025

At Acterys, we believe in fair competition, and we welcome comparisons that allow potential clients to make informed decisions. However, when competitors resort to spreading misinformation and misleading claims, its essential to address these inaccuracies head-on. Recently, we’ve encountered false narratives about our solution from some competitors.

Xero

FEBRUARY 10, 2025

We’re kicking off the new year with some exciting Xero updates designed to address some of the enhancements youve been asking for, and make things more automated to save you time. Keep reading to learn how these enhancements will benefit you and your business. Global: Enhancements to new invoicing [Product Idea ] You’ll love the time-saving enhancements we have made to new invoicing this month.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Withum

FEBRUARY 17, 2025

The SECURE Act 2.0 of 2022 introduces several significant changes aimed at enhancing retirement savings for American workers. Breaking Down Section 101 One of the key provisions, Section 101, focuses on expanding automatic enrollment in retirement plans. Heres what plan sponsors need to know: Automatic Enrollment Mandate: Section 101 mandates that new 401(k) and 403(b) plans must include an automatic enrollment feature.

Basis 365

FEBRUARY 17, 2025

If youre growing your business, your financial leadership is essential for sustainable success. However, not every business has the capacity or budget to hire a full-time, in-house Chief Financial Officer (CFO) or Controller. Thats where fractional financial professionals come in. But whats the difference between a fractional CFO and a fractional Controller, and which role would your business benefit from the most?

Menzies

FEBRUARY 17, 2025

Menzies LLP - A leading chartered accountancy firm. Professional Advice Its easy to shun the professional advisors when things start getting tough, especially when you are worrying about money and costs. The most successful people recognise their own skill sets and surround themselves with experts for everything else. Tap into your professional advisors knowledge and their network of contacts to find the right advice.

Going Concern

FEBRUARY 17, 2025

Announced February 13 , the AICPA and NASBA are giving up the quixotic fight to maintain 150 hours of education as the sole standard across CPA jurisdictions and are now “advancing model legislative language that enables an additional path to CPA licensure.” As has already been made law in Ohio recently , the alternate pathway option doesn’t eliminate 150 hours entirely, rather gives aspiring CPAs another option.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Canopy Accounting

FEBRUARY 19, 2025

Kristy Busija, CEO & Founder of Next Conversation Consulting, and host Nicole McMillan, SVP of People at Canopy, explore the evolving landscape of hiring and talent retention in the accounting profession. They emphasize the need for modernized recruitment strategies and flexible work models to attract top talent. Kristy urges companies to meet candidates where by embracing fractional employees and building a culture that reflects flexibility, inclusion, and transparency.

TaxConnex

FEBRUARY 13, 2025

Online businesses looking to do business on Native American tribal lands in the U.S. should know that sales tax obligations for these sovereign nations and territories resemble those obligations in other areas of the U.S. but can differ in important ways. Areas such as the Navajo Nation have tribal sovereignty; for tax purposes, this means their sales tax laws are separate from the states within which they reside.

Withum

FEBRUARY 3, 2025

Owning a car dealership can present a golden opportunity to reduce your tax liabilities. One such opportunity is cost segregation , allowing dealerships to speed up depreciation deductions, which can lead to significant tax savings early on. In this article, we’ll break down cost segregation, explain how it works, and show why it’s crucial for improving your cash flow and overall financial bottom line.

Anders CPA

FEBRUARY 17, 2025

March 26, 2025, 11:00 am 12:00 pm (CST) Regulation CC, implementing the Expedited Funds Availability (EFA) Act, has been amended by the Board of Governors of the Federal Reserve System (Board) to increase threshold amounts effective July 1, 2025. Banks and credit unions should prepare for the upcoming changes while also reviewing hold policies and processes.

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Let's personalize your content