Executives Expect More Deepfake Attacks on Accounting and Financial Data

CPA Practice

SEPTEMBER 18, 2024

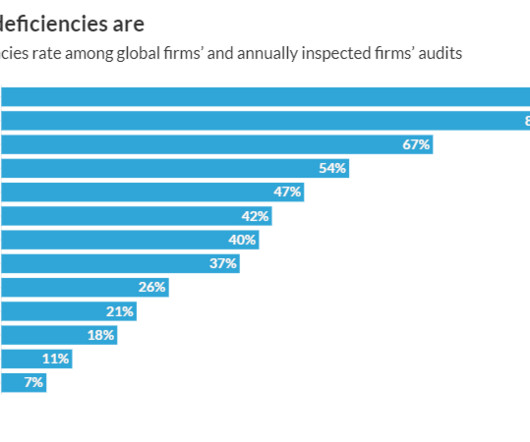

More than half of C-suite and other executives (51.6%) expect an increase in the number and size of deepfake attacks targeting their organizations’ financial and accounting data – otherwise known as deepfake financial fraud – during the next 12 months, according to a new Deloitte poll. That increase could impact more than one-quarter of executives in the year ahead, as those polled report that their organizations experienced at least one (15.1%) or multiple (10.8%) deepfake financial fraud incid

Let's personalize your content