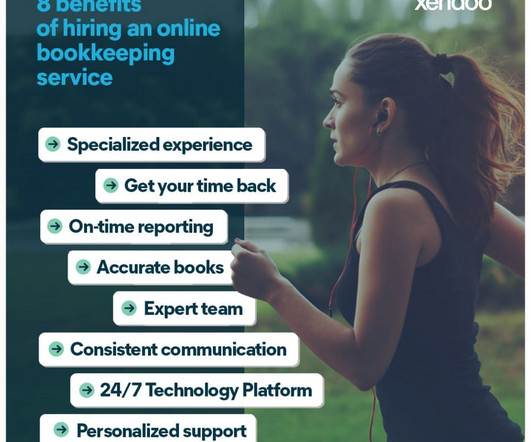

Specializing an Accounting Business: What and How?

PANALITIX

MAY 31, 2021

Specializing an Accounting Business: . Specialization is one way to distinguish your firm from the competition and generate more profitable work. and take action to increase profit. Cost Accounting. Project Accountant. Forensic Accounting. RESOURCES / ARTICLES. What and How? Corporate Treasury.

Let's personalize your content