Sales tax and accounting services

TaxConnex

MARCH 1, 2022

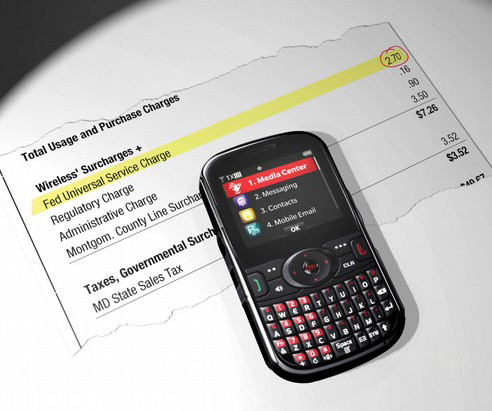

It’s that time of year again when everyone suddenly thinks about preparing their income taxes. But does tax preparation incur sales taxes – and if it does, where and how? For some 90 years, states have levied sales tax on goods (West Virginia was the first to do so , in 1921). Sourcing is huge.

Let's personalize your content