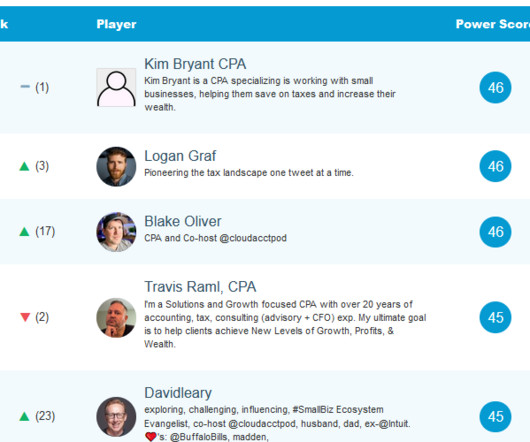

Accounting Top 100 Social Media Leaderboard – March 15, 2023

CPA Practice

MARCH 16, 2023

In 2018 Avalara launched our Accounting Top 100 Social Media Leaderboard. Our goal was to create a community of accounting professionals on Twitter to enable networking though engaging conversations and friendly competition. A seasoned Quickbooks Pro Advisor, she has built solid relationships within the Intuit Accountants community.

Let's personalize your content