FASB releases income tax disclosure standard

Accounting Today

DECEMBER 14, 2023

The Financial Accounting Standards Board issued an accounting standards update Thursday aimed at improving income tax disclosures from companies.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Accounting Today

DECEMBER 14, 2023

The Financial Accounting Standards Board issued an accounting standards update Thursday aimed at improving income tax disclosures from companies.

Cherry Bekaert

FEBRUARY 27, 2024

On December 14, 2023, the Financial Accounting Standards Board (FASB) expanded income tax disclosure requirements for public and private companies. The expanded disclosure requirements are detailed in Accounting Standards Update No. 2023-09 (ASU 2023-09) and increase transparency of a filer’s global taxes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Confronting the Change Challenge

The Financial Leaders Playbook: How To Deliver Insight, Oversight, And Foresight

How To Optimize Cash Flow: Your Roadmap To Resilience!

Usage-Based Monetization Musts: A Roadmap For Sustainable Revenue Growth

CPA Practice

DECEMBER 14, 2023

The Financial Accounting Standards Board ( FASB ) has issued an Accounting Standards Update (ASU) that addresses requests for improved income tax disclosures from investors, lenders, creditors, and other allocators of capital (collectively, “investors”) that use the financial statements to make capital allocation decisions.

Confronting the Change Challenge

The Financial Leaders Playbook: How To Deliver Insight, Oversight, And Foresight

How To Optimize Cash Flow: Your Roadmap To Resilience!

Usage-Based Monetization Musts: A Roadmap For Sustainable Revenue Growth

CPA Practice

MARCH 16, 2023

The Financial Accounting Standards Board released a proposed Accounting Standards Update (ASU) on Wednesday that addresses requests from investors for improved income tax disclosures.

Cherry Bekaert

FEBRUARY 12, 2024

On December 14, 2023, the Financial Accounting Standards Board (FASB) issued final guidance concerning income tax disclosures, labeled Accounting Standards Update No. For businesses surpassing specified quantitative thresholds, further disaggregation by taxing jurisdictions may be required.

Accounting Today

AUGUST 30, 2023

The Financial Accounting Standards Board voted to require companies to tell the public more about the taxes they pay, starting as early as 2025.

SMBAccountant

MARCH 8, 2023

One type of accounting that is well-known is tax accounting. According to Investopedia, tax accounting is “a structure of accounting methods focused on taxes rather than the appearance of public financial statements”. Tax accounting applies to individuals, businesses, and corporations.

SkagitCountyTaxServices

NOVEMBER 8, 2023

While there have been some good developments from the IRS with regard to Skagit County businesses like yours (primarily the business accounts option), there are also the negative implications of a more concerted effort by the IRS to collect unpaid taxes. in those accounts.

CPA Practice

OCTOBER 22, 2024

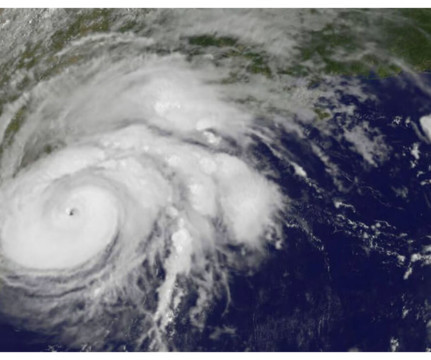

As residents across the southeast continue to pull their lives back together following the devastating destruction of Hurricanes Helene and Milton, the personal financial planning experts at the American Institute of CPAs are offering tips to help with financial well-being and planning for the future.

CPA Practice

APRIL 14, 2023

The Financial Accounting Standards Board (FASB) issued a new standard on March 29 that will allow reporting entities to consistently account for equity investments made primarily for the purpose of receiving income tax credits and other income tax benefits. Accounting Standards Update (ASU) No.

CPA Practice

APRIL 13, 2023

The Financial Accounting Standards Board (FASB) issued a new standard on March 29 that will allow reporting entities to consistently account for equity investments made primarily for the purpose of receiving income tax credits and other income tax benefits. Accounting Standards Update (ASU) No.

CPA Practice

AUGUST 6, 2024

The Financial Accounting Standards Board has issued its 2024 Investor Outreach Report. Those priorities include projects that address disaggregation of financial reporting information; income tax disclosures; accounting for environmental, social, and governance (ESG)-related transactions (e.g.,

ThomsonReuters

FEBRUARY 8, 2024

Jump to: What are the main accounting assumptions? Going concern assumption: A closer look How do common accounting assumptions relate to GAAP? Accounting assumptions, along with accounting principles and concepts, provide professionals with the necessary framework for preparing financial statements.

CPA Practice

MARCH 14, 2023

This article will provide a general overview of the current reporting requirements for foreign financial assets on the Report of Foreign and Financial Accounts (“FBAR”) and on Form 8938 under the Foreign Account Compliance Act (“FATCA”). Financial Interest A U.S. FBARs A United States Person (“U.S. US Person A U.S.

CPA Practice

MARCH 20, 2024

The Securities and Exchange Commission has accepted the 2024 GAAP Financial Reporting Taxonomy (GRT) and the 2024 SEC Reporting Taxonomy (SRT), collectively known as the “ GAAP Taxonomy ,” the Financial Accounting Standards Board (FASB) said on March 19. In addition, the FASB finalized the 2024 DQC Rules Taxonomy (DQCRT).

CPA Practice

MAY 28, 2024

taxpayers living and working outside the United States must their 2023 federal income tax return by Monday, June 17, according to the IRS. are allowed an automatic two-month extension to file their tax return and pay any amount due. Individual Income Tax Return. Income Tax Return PDF.

CPA Practice

AUGUST 9, 2024

The Financial Accounting Standards Board ( FASB ) has issued its 2024 Investor Outreach Report. Those priorities include projects that address disaggregation of financial reporting information; income tax disclosures; accounting for environmental, social, and governance (ESG)-related transactions (e.g.,

ThomsonReuters

JANUARY 18, 2024

Jump to: What are the roles and responsibilities for accountants? Accountant vs. CPA vs. tax preparer: What are the differences? GAAP and AICPA What issues should accountants be aware of in the profession? How can accountants be more efficient? Accountant responsibilities extend far beyond number crunching.

CPA Practice

DECEMBER 19, 2023

The Financial Accounting Standards Board (FASB) on Dec. 18 released the following taxonomies for 2024: GAAP Financial Reporting Taxonomy (GRT), SEC Reporting Taxonomy (SRT), and DQC Rules Taxonomy (DQCRT).

ThomsonReuters

DECEMBER 11, 2023

Accounting for tax equity investments Implementing ASU 2023-02 Accounting professionals with equity investor clients who are involved with projects to receive income tax credits and other income tax benefits need to have a clear understanding of the proportional amortization method (PAM), especially in light of recent changes.

ThomsonReuters

OCTOBER 12, 2023

Paying taxes on money earned abroad Avoiding double taxation Helping clients who live abroad with their taxes U.S. income tax returns, just like individuals living in the United States. However, the tax obligations for expats can be different and more complex due to their international status. tax return.

CPA Practice

DECEMBER 19, 2023

The Financial Accounting Standards Board (FASB) released what is likely to be its last proposed Accounting Standards Update (ASU) of 2023 on Tuesday, focused on improving the application and relevance of accounting guidance related to induced conversions of convertible debt instruments.

inDinero Tax Tips

MARCH 2, 2023

Bitcoin Tax Rate: What You Need to Know As the popularity of cryptocurrency grows, so does the scrutiny of tax authorities. The Bitcoin tax rate depends on the holding period of the cryptocurrency and the taxpayer’s income tax bracket. Do You have to pay taxes on cryptocurrency gains?

Cherry Bekaert

JULY 29, 2024

The Financial Accounting Standards Board (FASB) did not issue any new Accounting Standard Updates (ASUs) in the second quarter of 2024, while the Government Accounting Standards Board (GASB) issued one new GASB Statement. 103, Financial Reporting Model Improvements (GASB 103). 62 In addition to GASB statement No.

Cherry Bekaert

APRIL 26, 2024

The Financial Accounting Standards Board (FASB) issued two Accounting Standard Updates (ASUs) in the first quarter of 2024. The Government Accounting Standards Board (GASB) did not issue any new GASB Statements in the first quarter of 2024. Second, determining the proper accounting involves judgment.

Cherry Bekaert

FEBRUARY 12, 2024

The Financial Accounting Standards Board (FASB) released final guidance regarding income tax disclosures on December 14, 2023. Accounting Standards Update No. 2023-09 (ASU 2023-09) applies to all entities subject to income taxes and is intended to enhance the transparency and usefulness of income tax disclosures.

inDinero Tax Tips

APRIL 11, 2023

Incorporation is a critical legal matter that impacts more than your company’s tax responsibilities for doing business. Delaware is considered “the place” to establish your corporate entity as there’s no Delaware sales tax. Delaware offers perhaps the most favorable tax treatment to businesses. Historically, in the U.S.,

inDinero Tax Tips

MARCH 2, 2023

Bitcoin Tax Rate: What You Need to Know As the popularity of cryptocurrency grows, so does the scrutiny of tax authorities. The Bitcoin tax rate depends on the holding period of the cryptocurrency and the taxpayer’s income tax bracket. Do You have to pay taxes on cryptocurrency gains?

ThomsonReuters

OCTOBER 12, 2023

How to report foreign assets Form 8938 instructions FATCA considerations Helping clients with foreign assets In today’s global economy, many individuals and businesses have financial interests that extend beyond their home country’s borders. Report to the Foreign Bank and Financial Accounts (FBAR).

ThomsonReuters

OCTOBER 12, 2023

Jump to: What is foreign income? How to report foreign income What is Form 1099-DIV? Tax implications for owning property abroad What is FATCA? Helping clients with foreign income tax forms For U.S. citizens living abroad or earning income from foreign sources, questions often arise on how the U.S.

Going Concern

APRIL 15, 2022

To counter this perception, the accounting profession could be rebranded as a foundational force of social stability and progress, and not just as “a job” with long hours and low return on investment (ROI) on education. There is another way of putting this: Accounting is a profession whose brand has not been diluted.

CPA Practice

OCTOBER 11, 2023

Mark Anthony Gyetvay, a former CPA in Naples, Florida, has been sentenced to 86 months in prison for a scheme to hide millions of dollars of income in undisclosed Swiss bank accounts and submitting a false filing to the IRS. Additionally, and despite being a CPA, Gyetvay did not file personal tax returns for 2013 and 2014.

inDinero Tax Tips

JUNE 12, 2023

One of the most common problems for startup founders is the commingling of funds: when you pay for personal transactions from a business account, or visa versa. You’ll reimburse yourself if you’ve used personal accounts to pay for business expenses. This process will result in taxable income to the shareholder.

xendoo

FEBRUARY 15, 2022

How Do Tax Advisors Set Their Prices? A tax consultant will charge a fee based on different factors. The National Society of Accountants (NSA) reports that tax consultants typically charge between $176 and $457. It may cost more if you are filing more complex and specialized tax forms. Complexity of Services .

Withum

OCTOBER 11, 2023

The Internal Revenue Service (“IRS”) released Notice 2023-63 , on September 8, 2023, providing guidance surrounding the requirement to capitalize Section 174 research and experimental (“R&E”) expenditures for the 2022 taxable year.While many tax accountants and business professionals welcome the additional guidance, the timing was not ideal.

inDinero Tax Tips

MARCH 3, 2021

Whether you file your business’s taxes yourself or you have help, making sure your tax returns are right and on time is a lot easier when you. have a year-round reliable accounting team and. By outsourcing your business’s accounting and taxes with inDinero , you’re covered on both fronts.

FraudFiles

JANUARY 26, 2022

Any financial documents in the residence should be copied and put in a secure place outside the home. If you have access to account documents online, access and print all of the statements and related items. In order to ensure that everything is accounted for in the divorce, you should not rely on your memory going forward.

ThomsonReuters

FEBRUARY 1, 2024

Jump to: What are the GAAP accounting rules? GAAP rules for outstanding checks Staying up to date with GAAP standards Accurately tracking and presenting financial information can be complex, even for smaller organizations. Enter Generally Accepted Accounting Principles, more commonly known as GAAP. Let’s take a closer look.

inDinero Tax Tips

MAY 21, 2021

Even the recent Tax Cuts and Jobs Act (TCJA) legislation retained the provisions on R&D. All this to say, your company should include R&D credit in its tax strategy, if possible. Misconception #3: I don’t owe federal income taxes so it wouldn’t do much for me anyway. How do you claim the R&D credit?

inDinero Tax Tips

DECEMBER 18, 2020

However, the tax rules for startup costs can make a grown man cry. And maybe you can save a few dollars of income taxes along the way. It’s commonly known, when it comes to taxes, you can’t always get what you want— but with the help of the inDinero tax team —you can get what you need.

Cherry Bekaert

FEBRUARY 8, 2023

The Financial Accounting Standards Board (FASB) issued only six new Accounting Standard Updates (ASUs) and the Government Accounting Standards Board (GASB) issued only three new GASB Statements in 2022. Likewise, if a SWAP is amended, this can result in loss of special hedge accounting treatment.

MyIRSRelief

MAY 15, 2024

Understanding the Importance of Maintaining Tax-Exempt Status One of the primary concerns for any nonprofit is maintaining its tax-exempt status under IRC Section 501(c)(3). This status exempts nonprofits from federal income tax on their earnings related to their exempt purpose. and foreign tax laws. A : Not quite!

inDinero Accounting

JANUARY 9, 2023

Table of Contents What Makes Accounting Services for Startups Different? Why Is Accounting Important for Startups? However, a lack of accounting experience and knowledge can be a hindrance, especially for startups which need to be agile and primed for rapid growth. What Makes Accounting Services for Startups Different?

inDinero Accounting

JANUARY 9, 2023

What Makes Accounting Services for Startups Different? Why Is Accounting Important for Startups? How to Select the Right Startup Accountant. Getting Started with Startup Accounting. Accountants’ specialized knowledge can support your startup business in many ways. Table of Contents. Getting into legal troubles.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content