IR35 – where are we now?

Menzies

APRIL 18, 2024

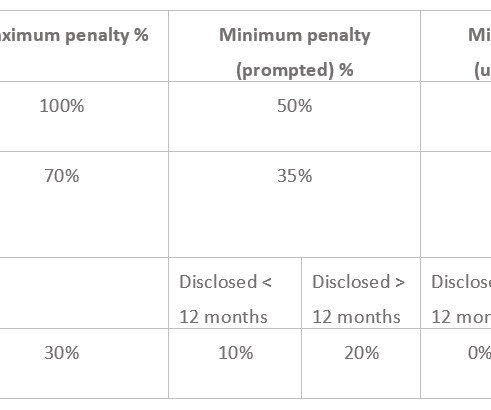

Menzies LLP - A leading chartered accountancy firm. The rules exist to ensure that in circumstances where a worker or contractor meets the definition of an employee, that worker pays broadly the same income tax and National Insurance contributions to that of a PAYE employee. What is IR35?

Let's personalize your content