South Carolina’s Top Accountant to Step Down After $3.5 Billion Error

CPA Practice

MARCH 23, 2023

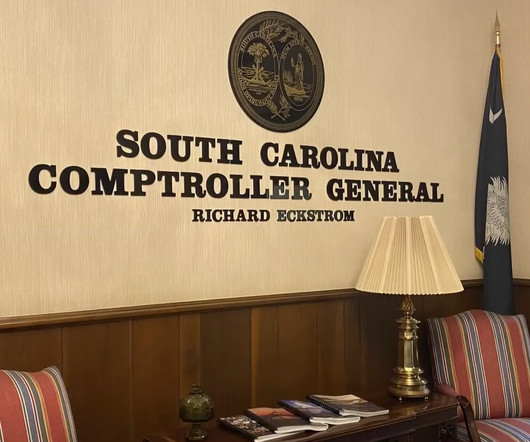

By Joseph Bustos, The State (TNS) South Carolina’s top accountant Richard Eckstrom says he will resign effective April 30 after disclosing to state lawmakers that he inflated the state’s cash balances for a decade, eventually reaching about $3.5 Larry Grooms, who led a Senate Finance Committee panel that investigated the $3.5

Let's personalize your content