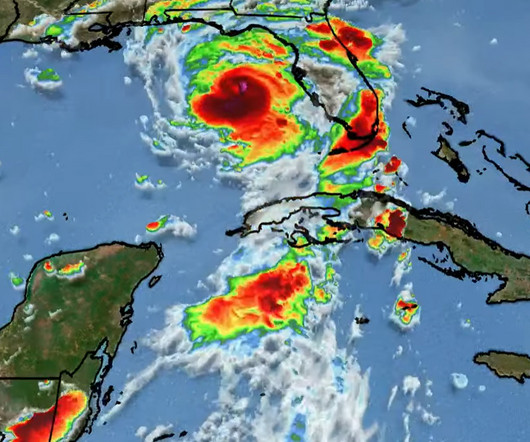

South Carolinians Get Tax Relief Following Tropical Storm Idalia

CPA Practice

SEPTEMBER 12, 2023

By Katelyn Washington, Kiplinger Consumer News Service (TNS) Following Tropical Storm Idalia, the IRS has granted tax relief to South Carolina residents impacted by the storm. The relief includes certain extended federal tax filing and payment deadlines. Some state tax filing and payment deadlines have also been extended.

Let's personalize your content