Tax, Accounting and Legal Pros are Cautiously Optimistic about Generative AI

CPA Practice

JUNE 21, 2023

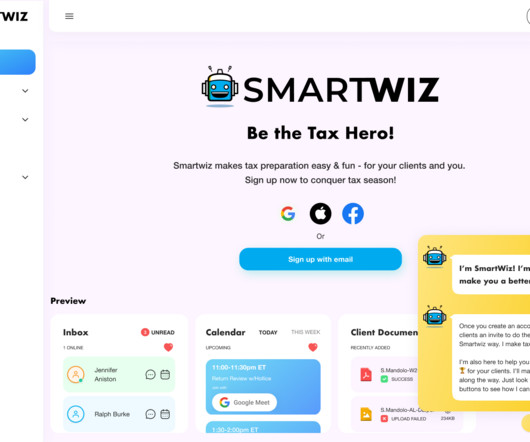

Artificial intelligence has been the focus of significant discussion within many professions, among them accounting, tax and legal. Furthermore, about half (52%) of all respondents believe that generative AI should be used for legal and tax work. What are the perils?

Let's personalize your content