How an Accounting Firm Can Help a New Small Business

PASBA

SEPTEMBER 12, 2019

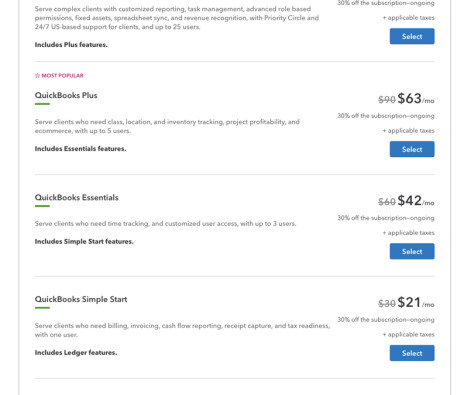

According to a 2018 survey conducted by Palo Alto Software, the owners of start-ups expressed interest in having an accountant assist them with a variety of tasks. How to Help New Business Owners through the Start-Up Process. Advice on choosing the most efficient accounting software.

Let's personalize your content