How a Point-of-Sale System Can Help on Small Business Taxes

CPA Practice

NOVEMBER 10, 2023

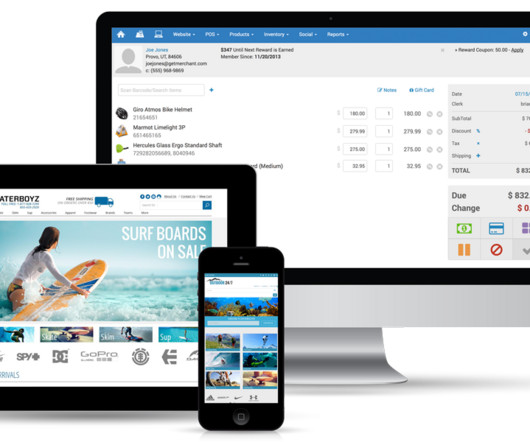

With these systems, owners are able to manage things like inventory, scheduling, and more. But, every year, these businesses must also prove that they’ve kept track of sales and are correctly reporting their earnings. Enter the small business accountant.

Let's personalize your content