More Than a Loophole: Delaware Sales Tax and Other Benefits of Incorporation in DE

inDinero Tax Tips

APRIL 11, 2023

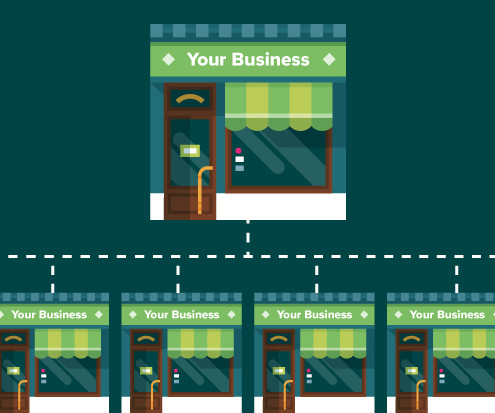

The four states that don’t have sales tax are Delaware, Montana, New Hampshire, and Oregon. inDinero can help set up an accounting system and prepare your taxes for any state where you do business—and make sure you’re filing the most advantageous Delaware tax return for your company.

Let's personalize your content