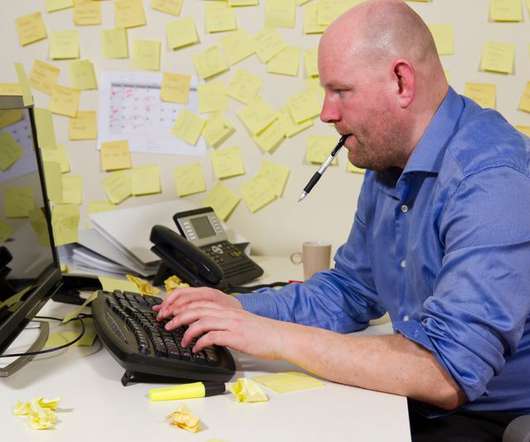

Accountants Behaving Badly: Police Department Accountant Couldn’t Be Bothered, PPP Loan Fraud, and a Creepy Tax Preparer

Going Concern

SEPTEMBER 25, 2023

According to allegations in the indictment, from January 2019 to June 2022, Urban was employed as a senior staff accountant for a Charlotte-based company. Both women are in their 30s, and both had been going to Flinchum for at least three years for tax preparation.

Let's personalize your content