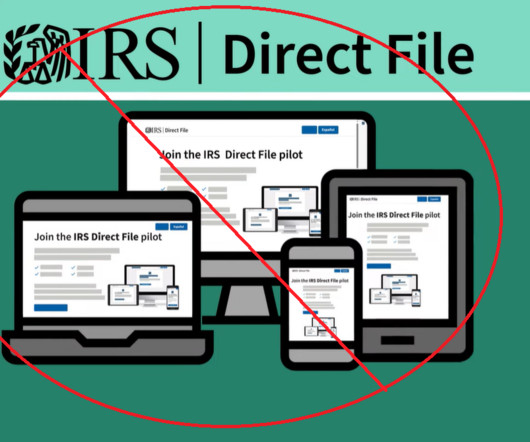

COUNTERPOINT: IRS Should Not Be Trusted With Direct File

CPA Practice

APRIL 11, 2024

The agency wants to file the citizen’s taxes, collect that money, and double back to conduct audits—without any mediating institution to gainsay potential (nay, likely) abuse. An audit by the Treasury Inspector General for Tax Administration (TIGTA) could not confirm the IRS’s cost assumptions—nor could the agency meaningfully defend them.

Let's personalize your content