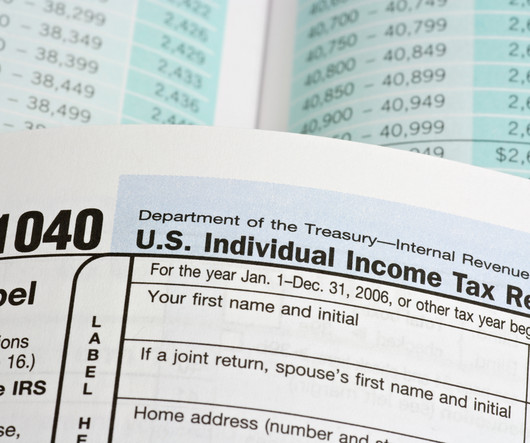

His? Hers? Whose Name is Usually First on Joint Income Tax Returns?

CPA Practice

AUGUST 7, 2023

Taylor, Kiplinger Consumer News Service (TNS) Does the order of names on your joint federal income tax return reveal significant things about you and your partner? A recent study suggests the answer could be yes—that tax return name order may hold some clues about social norms and beliefs. By Kelley R.

Let's personalize your content