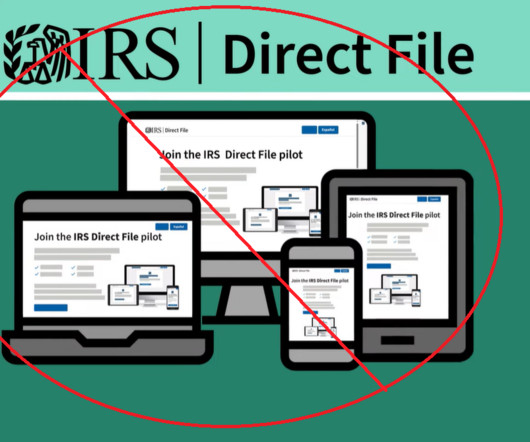

COUNTERPOINT: IRS Should Not Be Trusted With Direct File

CPA Practice

APRIL 11, 2024

This year, the IRS has launched a pilot program dubbed “Direct File” through which Americans can opt to have the IRS prepare their taxes for free (well, except for the billions of taxpayer dollars used to create the program). The IRS wants to eliminate Americans’ reliance on private-sector tax-preparation services.

Let's personalize your content