The Ultimate Guide to Bookkeeping for Home Service Contractors

Steve Feinberg

SEPTEMBER 7, 2023

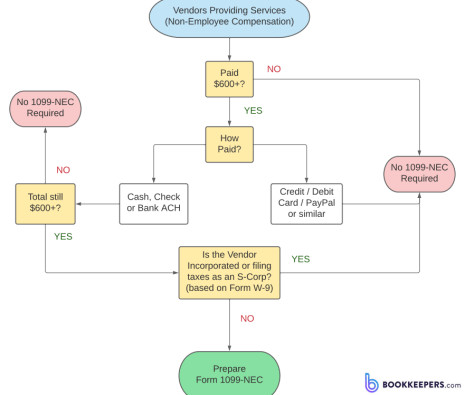

Importance of Bookkeeping for Home Service Contractors Bookkeeping for small construction businesses and home service contractors is crucial for many reasons. Bookkeeping software can help you automate payroll and streamline the entire process. See also: Quickbooks for advertising agencies.

Let's personalize your content