How Does Online Bookkeeping Work?

xendoo

MARCH 17, 2022

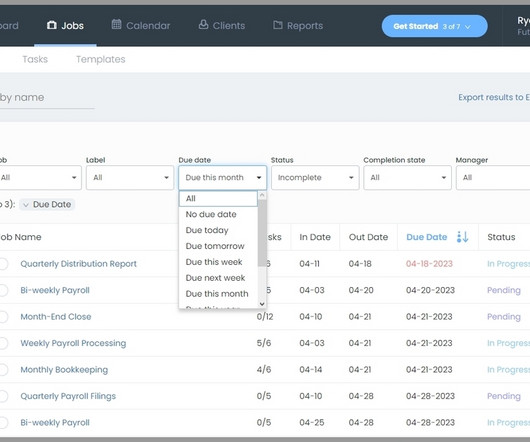

Small business owners around the world are migrating to cloud-based bookkeeping software to keep their financial records and reports organized and accessible. Even with the help of bookkeeping software, it takes financial expertise to put the data into context and use it to make informed decisions. Going Digital.

Let's personalize your content