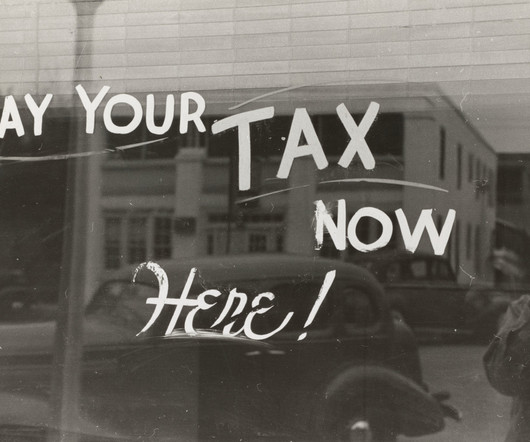

Enrolled Agent Near Me: Comprehensive Tax Services for Individuals and Businesses

MyIRSRelief

OCTOBER 11, 2024

If you’re searching for an “Enrolled Agent near me,” you’re likely looking for someone who can provide a wide range of tax services. Get help today by calling us at 1-877-78-TAXES [1-877-788-2937]. Get help today by calling us at 1-877-78-TAXES [1-877-788-2937].

Let's personalize your content