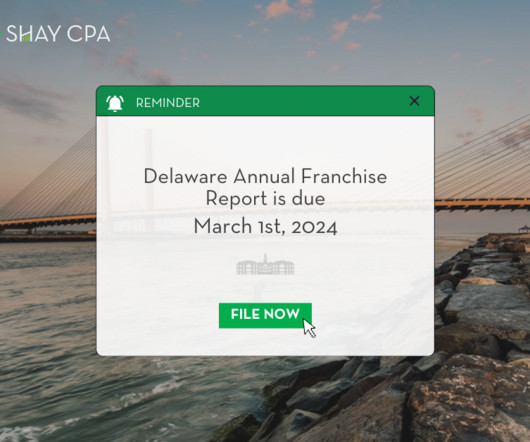

Your Essential Guide to the Delaware Annual Filing – 2024

Shay CPA

FEBRUARY 8, 2024

Every corporation incorporated in the State of Delaware is required to file an Annual Franchise Tax Report and pay the associated franchise taxes. The purpose of this tax is to maintain the corporation’s good standing status within the state.

Let's personalize your content