IRS Shoots Down Rumors of More Stimulus Checks

CPA Practice

DECEMBER 7, 2023

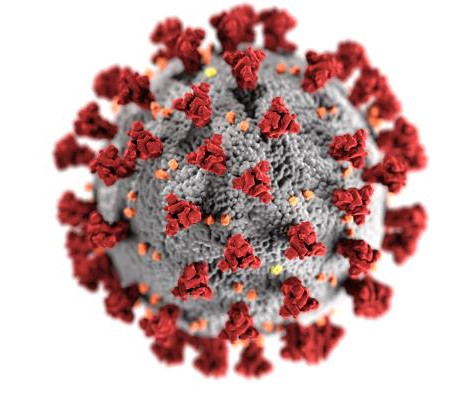

Three rounds of stimulus checks—known officially as Economic Impact Payments—were sent by the federal government to income tax filers between March 2020 and March 2021 as a way to offset some of the hardships of the COVID pandemic. “There is no fourth round of [stimulus checks] from the Treasury Department,” he said.

Let's personalize your content