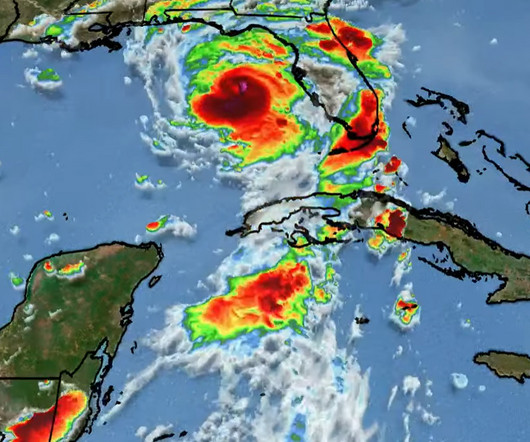

South Carolinians Get Tax Relief Following Tropical Storm Idalia

CPA Practice

SEPTEMBER 12, 2023

By Katelyn Washington, Kiplinger Consumer News Service (TNS) Following Tropical Storm Idalia, the IRS has granted tax relief to South Carolina residents impacted by the storm. Tropical Storm Idalia hit South Carolina on Aug. 15 to file quarterly payroll and excise tax returns that were normally due on Oct.

Let's personalize your content