QuickBooks Ledger: Welcome to the Family! We’re Glad You’re Here.

Nancy McClelland, LLC

MARCH 8, 2024

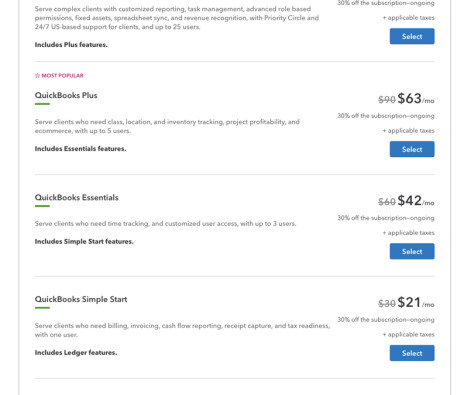

Especially because these are the same characters that tend to be super price-conscious, and are somehow convinced that because they have a low volume of transactions, they shouldn’t have to pay for the monthly QuickBooks Online subscription – “can’t you just use our bank statements or a spreadsheet?” Enter QuickBooks Ledger.

Let's personalize your content