Budget Season is Here, Are you ready?

Basis 365

OCTOBER 1, 2022

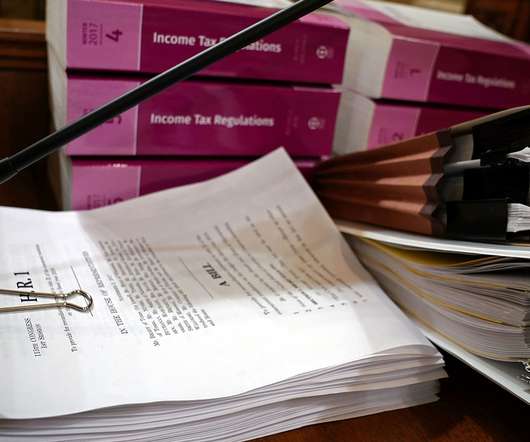

Budget season has begun, and financial teams need to get together to plan for 2023. But are you ready? A business owner cannot afford not to have a budget in place for the new year. Budgeting is about making plans, identifying opportunities, and keeping the doors open for the following year. Developing the budget for next year doesn't have to be challenging.

Let's personalize your content